Burial Insurance with Fibromyalgia

By Matt Schmidt

Last Updated on February 24, 2026 by Matt Schmidt

Fibromyalgia is considered one of the most painful disorders to have. The brain amplifies pain signals from the brain causing chronic pain accompanied by constant fatigue, sleep, memory and mood issues. Affecting the muscles and soft tissues, fibromyalgia can be remedied through medications, lifestyle changes, and stress management.

Some individuals have been turned away from receiving burial insurance due to their fibromyalgia. That stops now. Working with us, we will be able to get you a low rate with multiple companies with no waiting period. Not only that, but we will double down and get you insurance that will go into effect the day you purchase it.

The following article will help you get a better understanding of how we are able to find you the best burial insurance policy out there regardless of your fibromyalgia diagnosis.

You have fibromyalgia and are concerned that you are going to be turned down for life insurance. Although some companies will cause you to jump through a million different hoops the truth of the matter is, 99% of final expense insurance companies really do not care too much about fibromyalgia. As long as you have no other very serious health conditions the majority of the companies we work with will be able to offer your immediate coverage at some of the best rates on the market the very day you sign up.

The best part, you won’t even need to provide your medical history or go in for any physicals. You simply need to answer a few health questions and be on your merry way.

For the most part, there are two primary background checks, burial insurance companies will complete, to access your health profile. They will have you fill out a quick health questionnaire and check your prescription history. Your answers to the health questions, including the severity and treatment of fibromyalgia, and the background check of your prescription drugs, will give the insurance company all of the information they need to determine whether or not you’re insurable. It’s that simple.

Again, there are no medical exams or medical records for these types of burial insurance policies.

When it comes to the health questions keep in mind that insurance companies tend to only ask about very high-risk health issues. Luckily for you, fibromyalgia is nowhere near being considered a high-risk health issue. The usual health questions are below.

Has a member of the medical profession ever diagnosed or treated the Proposed Insured for Acquired Immune Deficiency Syndrome (AIDS), AIDS-Related Complex (ARC), or any immune deficiency disease; or has the Proposed Insured tested positive for the Human Immunodeficiency Virus (HIV)?

Generally, answering NO to these types of health questions aren’t too hard to do. However, if you answer YES to one or more of these, you may only qualify for guaranteed acceptance policies. It’s always best to speak with an agent, share with us your health profile, and we can then help determine what type of burial insurance policies you’d qualify for.

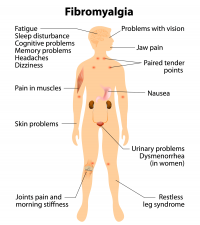

The following are a list of some of the most common symptoms that are related to having fibromyalgia.

Some other lesser known symptoms that may occur due to fibromyalgia include, but are not limited to the following.

As previously stated your medication history will also be looked at. Using your medication prescription history, the insurance company is able to see any red flag prescriptions. These type of red flag prescriptions will help identify any serious health issues you may have.

Generally, burial insurance carriers will do a two-year look back, into the medications that you have been prescribed. It’s usually a good idea to speak with an agent, discuss your medication history, as it will help a burial insurance advisor make suitable recommendations.

When it comes to fibromyalgia, there are no drugs that are solely meant for the treatment of fibromyalgia. Lyrica, was the first drug on the market that was approved to treat fibromyalgia however recently has been used to also help with neuropathy and seizure disorders as well. Due to this type of drug being used for multiple purposes, some companies may decline due to taking Lyrica. While others may simply ask you what is reason for taking Lyrica.

Fibromyalgia is treated using pain relievers, antidepressants as well as anti-seizure medications. Keep in mind that some burial insurance companies have issues with taking medications for depression or seizures. Luckily for you, we work with multiple companies that do not hold bias towards individuals who struggle with depression or seizure conditions.

After reviewing your entire health history, we are able to have a better understanding of what your own personal limitations are and how we can find burial companies that will suit your needs best. Being aware of all of the variables that we see with your health history and medications will allow us to recommend a company that will offer the best services for the best price. A quick 5 minute phone call to 800-470-0179 is all it takes to start the process.

Another common misconception is that having fibromyalgia and diabetes is two strikes against you when it comes to burial insurance for diabetics. Although the combination of these two conditions won’t cause you any issues certain medications may impact your options.

Not only are the following drugs prescribed for fibromyalgia patients but they are also used to treat neuropathy.

If you are in this situation where you are taking any of the previously stated drugs as well as any of the diabetes drug the insurance companies tend to assume you have a diabetic neuropathy disorder. That’s where we come in. We collaborate with multiple companies that will not charge you those increased prices or make you sit through the waiting period. If you have neuropathy, don’t feel defeated. We will be able to find you the perfect fit.

Often times all it takes is for an agent, to provide the details to your health profile, to an Underwriter. By going the extra mile, we can hopefully find you one of the better-priced options out there.

The overlap is where we run into the problems. Neuropathy is a very serious condition where the nerves get damaged in the legs and feet caused by diabetes. Because of this a lot of companies will impose a waiting period to be insured as well as increasing your rates significantly.

Dealing with fibromyalgia is painful enough. When it comes to your policy options, we will be able to qualify you for a level death benefit. What is a level death benefit? It is coverage that will be effective immediately at the lowest cost offered. Calling us and talking through any other possible health conditions you may have will allow us to find the best policy option out there. Don’t feel hopeless. We’re here to help.

Generally, people will qualify for two main types of final expense plans.

Don’t feel overwhelmed! Our agents will help you determine what options you’ll have.

Quality burial insurance is extremely hard to come by. A lot of companies out there are trying to scam you into thinking you have found a deal when in all actuality you’re getting the raw end of the stick. They are only looking out for themselves and making money. Let us do the heavy lifting and find you the best burial insurance plan that costs you the least and protects you from day one. Using your health background will allow us to whittle away at all of the companies out there to find your perfect fit!

We know that this insurance policy will at some point, help your family pay for funeral expenses, and other final expenses. That’s why it’s important to find the company that will pay out the death claim, in the timeliest manner.

Keep in mind, buying through an agency does not mean you’re going to be paying more. As a matter of fact, several burial insurance plans have to be purchased thru an agent, and are not available to be purchased directly by the company. Not to mention, if you need customer service do you want to call into a random 800 number, and sit on hold for 30 minutes? Or would you rather call your agent directly, and speak with them? Regardless of which medium you use to purchase your insurance, the law mandates that all insurance prices must be equal.

Having fibromyalgia shouldn’t hold you back when it comes to making burial life insurance decisions. If you’re looking for burial insurance that is the best for you and most cost effective, look no further. Our focus here at Burial Insurance Pro’s is burial insurance. That’s what we do and what we excel in. The years of experience we have with our clients allows us the knowledge to know which insurer would suit your needs the best.

If you want an experts opinion, fill out the quote form or give us a call to help you out in all of your burial needs! A quick call to 800-470-0179 is all that it will take. Don’t put off this important financial matter any longer!