Great Western Insurance Company Review for 2024

[lmt-post-modified-info]

When it comes down to it, you plan for every aspect of your life…your children’s education, birthday parties, family vacations, even your retirement. All of the fun stuff you get to look forward to in life is usually planned for, but it is also time to start planning for some of the harder things in life as well. It makes sense to start planning for your final expenses to relieve any potential financial burden from your family during that time. Don’t find yourself in a situation where you think everything will just work itself out. Take the time now, while you can, to truly prepare effectively for when that time comes. No one wants to spend the day scouring the Internets for life insurance to cover your parents final life burial costs. It can be extremely frustrating and at times just down right confusing. One site says one thing, while another site almost says exactly the opposite. Where do you even begin? When looking for burial insurance, look for the following criteria.

When it comes down to it, you plan for every aspect of your life…your children’s education, birthday parties, family vacations, even your retirement. All of the fun stuff you get to look forward to in life is usually planned for, but it is also time to start planning for some of the harder things in life as well. It makes sense to start planning for your final expenses to relieve any potential financial burden from your family during that time. Don’t find yourself in a situation where you think everything will just work itself out. Take the time now, while you can, to truly prepare effectively for when that time comes. No one wants to spend the day scouring the Internets for life insurance to cover your parents final life burial costs. It can be extremely frustrating and at times just down right confusing. One site says one thing, while another site almost says exactly the opposite. Where do you even begin? When looking for burial insurance, look for the following criteria.

- Find a burial insurance company that has a financial stable track record that is able to pay out any and all claims

- Find a policy that will protect you as soon as you sign up

- Find the lowest monthly premium that will allyou to have the best burial insurance coverage possible

The best time to get burial insurance is now. With every day that you let pass, the policy that you could have obtained a week ago will be more expensive in price. The sooner you have it, the sooner you will appreciate it. Great Western Insurance company has developed an extremely innovative solution to help pay for final expenses. Before we dive into all of the logistics, let’s take a step back an look at the company as a whole.

A Brief Overview of Great Western Insurance Company

Great Western Insurance Company was founded by a gentleman named John E. Lindquist from Ogden, Utah in 1983. Owner of Lindquist Mortuaries & Cemeteries, a family business with five generations his funeral background gave him the knowledge and insight necessary for the simplest and most effective policy design available, as well as the pre-need marketing support to go with it. From the beginning Great Western Insurance based its company on writing life insurance and annuities specifically to fund pre-arranged funeral plans. Since then Great Western has been providing funeral home owners and pre-need sales organizations with exceptional service and superior marketing support.

Great Western is licensed in 46 states and the District of Columbia and is continually ranked as one of the top pre-need insurance companies in the United States. One of Great Western’s biggest strengths is always coming from a dedicated focus on the funeral profession. Because of this, Great Western knows the financial needs of funeral homes, the families they serve, and understands the responsibility of being a trusted financial steward. As a result, all investments are professionally managed under diversified and conservative guidelines. Great Western’s Surplus to Liability Ratio is among the highest in the industry, exceeding the margin of assets over liabilities and excess surplus standards that are averaged by America’s 25 largest life insurance companies.

Financial Track Record

An important step in finding the right burial insurance company is making sure the company you pick has the financial stable track record that is able to pay out any and all claims. Unlike a lot of other companies who post this information on their websites, we were unable to find anything on Great Western. Although some may find this as a red flag, we were able to find their ratings through A.M. Best.

Most companies that we recommend fall in the the ‘A’ category when it comes to A.M. Best Company and their rating scale. Please keep in mind the ‘A’ scale can be anywhere from A++ to A-. Great Western has the rating of B++, not “technically” in the ‘A’ scale however pretty close in our opinion. Although some individuals may be wary to do business with a company with an unkonwn financial track record, we should note another rating from A.M. Best. They rate Great Western in the BBB+ category for their Long-Term Issuer Credit Rating. This shows that the company is in a strong position to meet all financial liabilities and obligations in the long-term. Which should let you rest a little easier knowing they are rated high when it comes to being able to pay out any and all claims.

Products Available

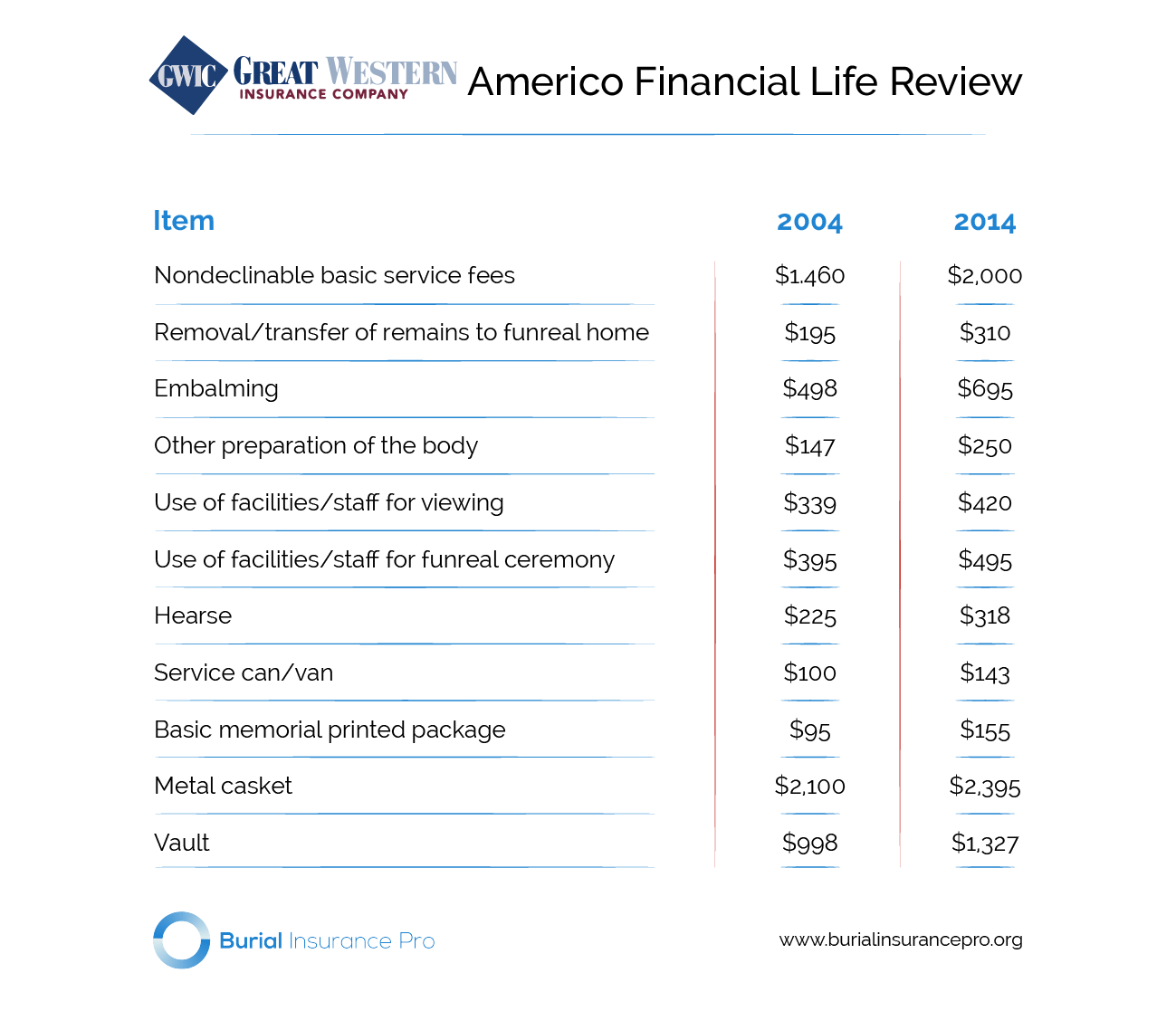

Funerals are expensive. Even your bare minimum funeral could cost your family anywhere from $8,000-$12,000. That is not a typo, you read that right. In 2014, according to the National Funeral Directors Association, the average cost of a funeral was roughly $8,508. A noticeable increase in price from 2004, which was about $6,580. The image on your right will give you a better estimate of some of the costs of a funeral courtesy of the NFDA. Please keep in mind these figures are just estimates of the bare minimum and do not include the cost of cemetery, flowers, obituaries or crematory fees. On average in the last 10 years the cost of a funeral increase roughly 30%.

There are two main products that Great Life Insurance has to offer that are both centered around pre-planning a funeral. By planning your service in advance you can design and specify the exact type of service you’d like, so that your friends and family celebrate you as you wish. And by letting your family know how you’d like your funeral or memorial service to be, they’ll have less difficult and complicated decisions to make during a difficult emotional time.

Pre-Need Insurance – allows you to plan your funeral in advanced. Great Western offers a product that allows you to, as its tagline suggests “it’s your story to tell”, tell your own story. From planning your funeral both in terms of financial this type of insurance allow your family a piece of mind knowing they won’t have to desperately search for money for the funeral. It takes all of the stress and responsibility away and leaves your family the ability to focus their attentions elsewhere.

Final Expense – is designed to cover the bills that your loved ones will face after your death. These costs will include medical bills and funeral expenses. Similarly to a lot of other companies out there, Great Western offers a final expense product that will help cover your final expenses including (but not limited to) household expenses, mortgage payments, medical bills, court fees, credit card debt and car loans.

For a more detailed look into some of the products Great Western has to offer, take a look at their complete brochure below.

Additional Great Western Information

Finding a policy that will protect you as soon as you sign up is a must when it comes to burial insurance. When you choose the final expense option with Great Western the application process is quick and easy. So easy that as long as you keep paying your premiums, your policy cannot be canceled until you pass away. Which at that point in time will go directly to your beneficiary.

Additional policy options include having a Spousal Bonus Rider that provides support to your partner during the time they may need it the most. You can also choose to add an Accelerated Death Benefit, Grandchild Rider, or even a Dependent Child Rider. What this means it that in addition to covering your life, your life insurance policy will provide a death benefit in the case that one of your previously mentioned riders pass away. Bonus, these additional policy options can be added with no additional charge.

Great Western Bottom Line

We know it’s hard to tell if a company is a good fit or not for you. What’s nice about Great Western Insurance is being able to take any of their policies out for a spin. They offer a 30-day test drive where you can sign up and use the policies for what they call a “free-look-period”. If you’re unsatisfied for any reason and you change your mind, you can cancel the policy within 30 days and there’ll be no evidence you ever had a policy in place.

We want to make sure the “right company” for you is the one that provides you with appropriate recommendations, products, and prices have a record of outstanding customer service, and the financial capacity to meet its financial obligations to you and your beneficiaries when they come due. Seeking assistance from an insurance professional can help with that. To be honest, most people buy life insurance through agents or brokers for good reasons. Determining how much and what kind of insurance to buy is one of the most important financial decisions you’ll ever make, but it’s also one of the most complicated. A qualified insurance professional will conduct a thorough insurance needs analysis and provide you with policy recommendations that are based not just on knowledge of company ratings, but on personal dealings with the companies he or she is recommending.

Let Us Help!

At Burial Insurance Pro’s, we have the knowledge and know it relates in the burial insurance world. We know the ins and outs of these companies, including those who may or may not approve you for a reasonably priced policy. Why waste time and energy seeking policies from companies who will just decline you or ask you to pay a ridiculously high policy rate?

We have helped many people find the coverage they need at a price that is affordable. Let us help you make solid recommendations that are tailored to you and your lifestyle. We know your options and we help you sort through them – answering any questions you may have along the way. You are not in this alone. Contact us today to get started!