Funeral Insurance: How to Find the Best

By Matt Schmidt

Lucky for you, we have taken the legwork out of it and will help lead you through the process to find the best type of funeral insurance for you. In the event you’d like to speak with an agent simply call us at 844-334-6143. We’d love to discuss what options you may have available for funeral insurance coverage.

We would argue that anyone who does not have a life insurance policy ‘earmarked’ for addressing your funeral needs would benefit from a funeral insurance policy. Otherwise, how else would you guarantee there would be a policy for your family at the time of your death?

Funeral insurance is generally a term given to a burial insurance policy. It’s also referred to as a final expense insurance policy. Why? Because people tend to purchase a life insurance policy for the specific reasons to address their burial, funeral, and final expenses.

At the time of the insured’s death, the policy would pay out the death benefit to the beneficiary. This benefit can then be used to address any types of expenses. There are NO restrictions on how the money can be used.

These whole life insurance policies never require a medical examination nor a review of any medical records. Policies will have guaranteed premiums, as well as a death benefit that will cover the insured’s entire life. At the time of death, the policy pays the full amount of the policy to the beneficiary. This is paid out in a timely manner, and also in a lump sum tax free payment

For some people, a minimum of $10,000 in coverage is often needed. Others may need closer to $25,00 to address their funeral needs.

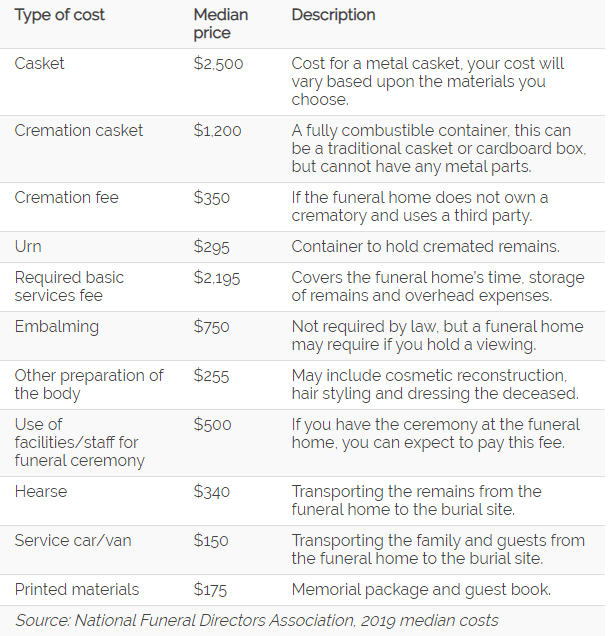

Here is a list of possible funeral expenses:

Burial insurance policies are a great way to manage your final burial expenses, especially if you do not have any existing life insurance policy. Figuring out your funeral and burial needs in advance will be a blessing to your family. The first step is to determine how much burial insurance you may need.

It’s always most likely beneficial to speak with your family, and review your personal situation. Choosing the perfect final expense insurance, or funeral insurance policy should generally be discussed with your family.

Honestly, it depends entirely on your situation. Your financial status and your family’s budget are two considerations that should be factored into deciding. If you have no life insurance coverage we would highly recommend buying burial insurance. That way you will have funds available for paying for your funeral in the future covering your family from any and all unexpected occurred expenses.

For most people, depending on their health, you’d have a plethora of choices to choose from in terms of burial insurance providers. Many people consider popular companies such as Mutual of Omaha, Lincoln Heritage, Sentinel Security and Great Western Insurance company.

Companies like these provide policies that provide an immediate death benefit policy, that pays out without any two year waiting periods. No medical exams are ever needed, and oftentimes approval to applications take less than a day. All policies are whole life insurance products that cover a person’s entire life.

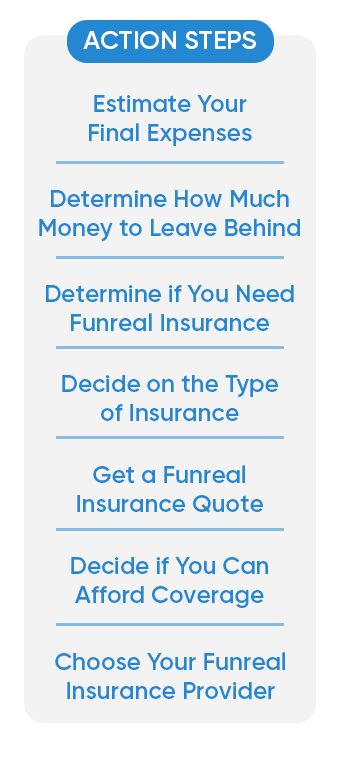

Step 1: Figure out how much you will need to cover the cost of your funeral. On top of that you need to take into consideration additional services that you may need to pay for. This also includes any remaining medical bills, legal costs and outstanding credit card bills.

Step 1: Figure out how much you will need to cover the cost of your funeral. On top of that you need to take into consideration additional services that you may need to pay for. This also includes any remaining medical bills, legal costs and outstanding credit card bills.

Step 2: Make sure there is enough money to cover your final expenses. This is something you can start saving for now. The sooner you start putting money aside for your final expenses the better off you will be in the long run. Keep in mind having these funds readily available will help when it comes time to pay for the funeral. This way those funds can be used immediately. Speaking to a financial advisor may help with this step.

Step 3: Figure out if you even need funeral insurance. If you plan on having a substantial amount of funds at the end of your life to cover your final expenses you may not necessarily need funeral insurance. However, if you do not think you will have available funds to cover your final life expenses then you definitely should look into getting funeral insurance. It will take the burden off of your family and loved ones during an already sad time ensuring that your entire estate will be available to them.

Step 4: Decide on the type of insurance you will want. This step tends to be a bit overwhelming to some. These policies tend to cover between $25,000-$40,000 compared to regular life insurance policies because they are only covering final expenses.

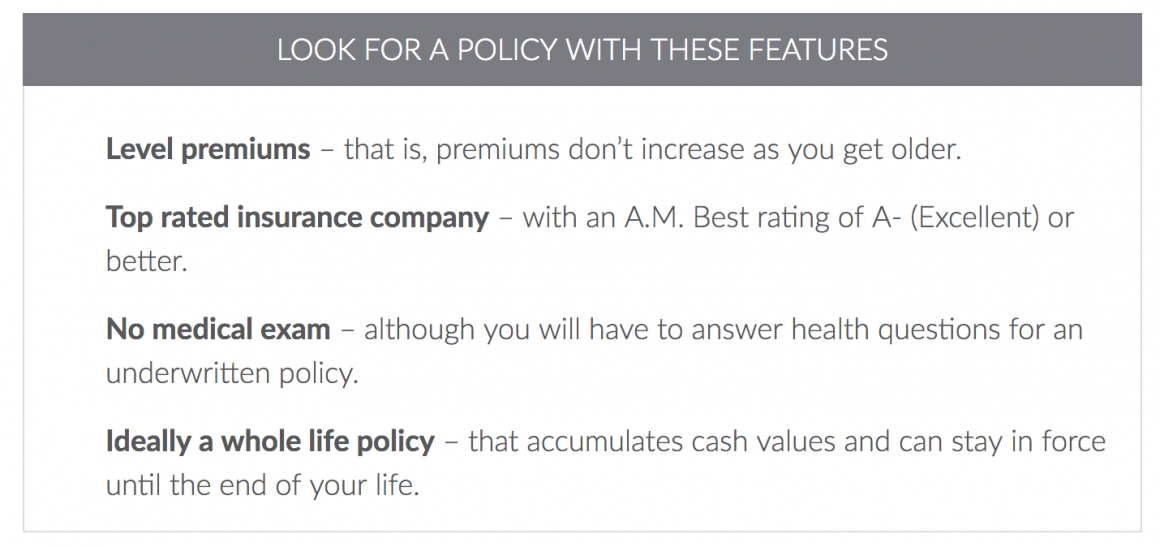

When it comes straight down to it, you’re looking for the best policy for you and your family…the best policy that won’t necessarily cost you an arm and a leg. When looking for burial insurance you will want to find a plan that has 3 critical components.

Step 5: Every person’s funeral insurance needs will vary. Requesting a quote will allow you to get a better idea of how much you will actually need. If you want an experts opinion, fill out the quote form or give us a call to help you out in all of your burial needs!

Step 6: Figure out of the type of insurance you decide on is the type of insurance you can afford. Insurance tends to be a highly regulated product. For the most part, all policies and rates are filed on a state by state basis. Which means you really can’t find a discount anywhere. Beware of those offers you may see that are too good to be true. There are companies that will work very hard to sell you insurance plans where the prices increase with age, and the policy expires at a certain age. Do not buy from these companies!

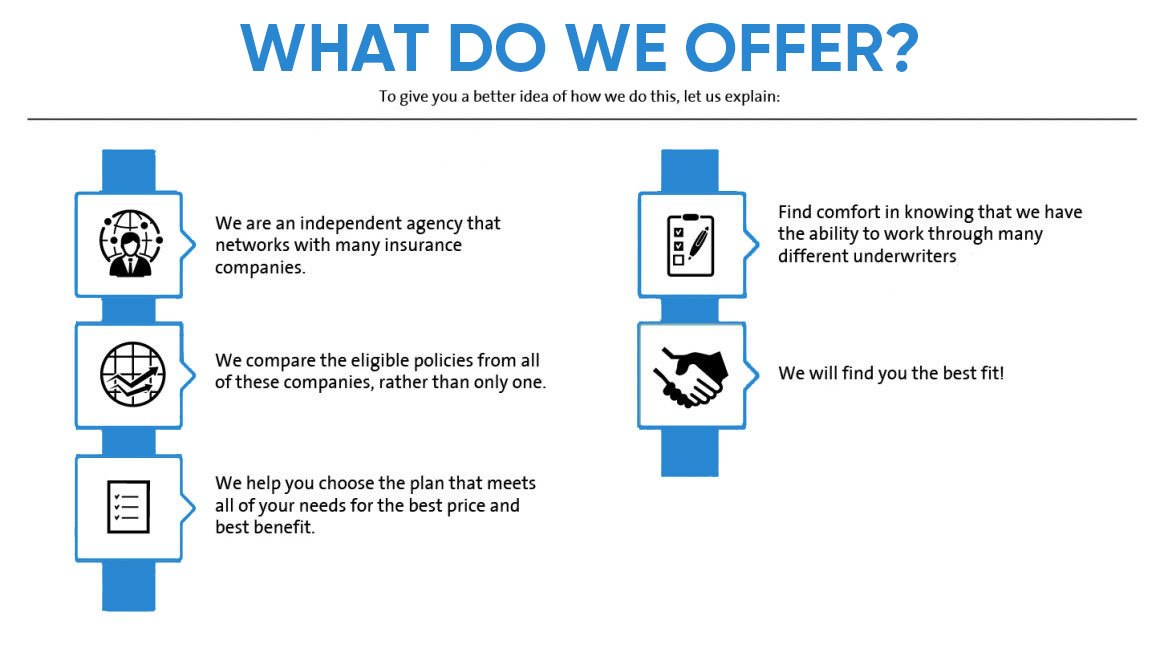

Step 7: Choose a funeral insurance provider that you can purchase through agents like us. We are able to get you the best deal by purchasing directly from the insurance company. We will be able to walk you through any questions you have along the way and give you the reassurance that the type of funeral insurance you are choosing fits best to your lifestyle.

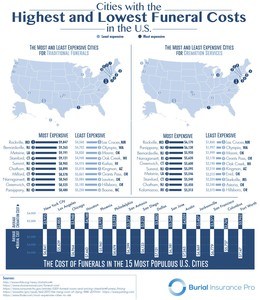

As you are aware, the state, and city you live in will have an impact on your funeral costs. Funeral homes will have different pricing depending on your geographical location.

If you’re looking for burial insurance that is the best for you and most cost-effective, look no further. Our focus here at Burial Insurance Pro’s is burial insurance. That’s what we do and what we excel in. The years of experience we have with our clients allows us the knowledge to know which insurer would suit your needs the best. Please simply complete a quote request, or call us. We’d love to speak with you, and provide you with the information you are seeking. We can be reached at 844-334-6143.

If you want an experts opinion, fill out the quote form or give us a call to help you out in all of your burial needs! We promise to make the funeral insurance application process as easy as possible for you and your family.