Burial Insurance For Seniors Over 80

By Matt Schmidt

Last Updated on February 24, 2026 by Matt Schmidt

Time and time again we find individuals coming to us in need of final expense life insurance. Other companies have told them that it’s too late or that seniors over the age of 80 can’t receive final expense life insurance due to their age. We are here to let you know, that is not true and we are here to help.

Our Burial Insurance Pro’s can help secure life insurance for seniors over 80 at a price that is still affordable!

Not only are there tons of burial insurance companies out there that issue to individuals 85 years old or younger but also the coverage they offer goes into effect immediately. As there is no waiting period. None! Some companies may even offer coverage thru age 89 or 90, depending on your overall health, and state of residency.

The time is now. Now is the best time to plan on obtaining burial insurance to ensure your final expenses are taken care of and your premiums stay low. Keep in mind that your burial insurance will never be cheaper than it is today. The sooner you have it the sooner you’ll appreciate it. This will be one less financial worry for you, and one less financial burden for your family.

Let us breakdown the cost of a funeral, how burial insurance policies work, and how to find the best burial insurance for seniors over the age of 80.

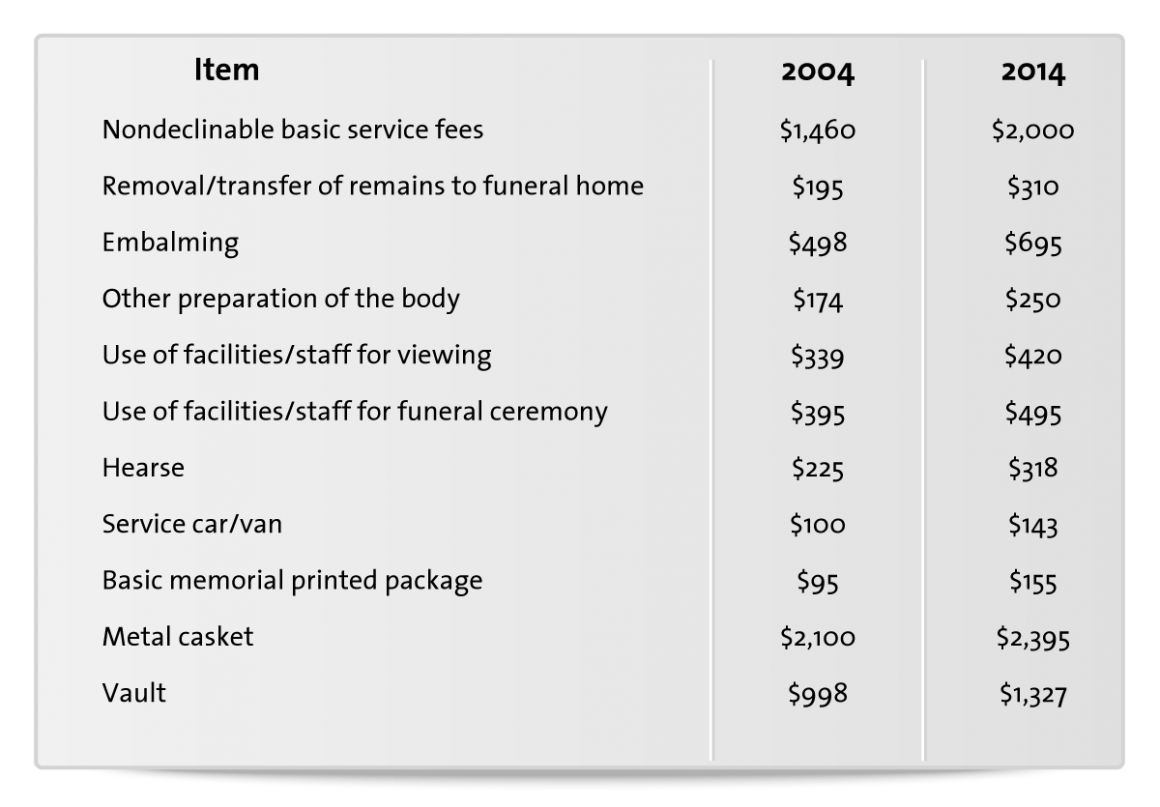

In 2014, according to the National Funeral Directors Association, the average cost of a funeral was roughly $8,508. A noticeable increase in price from 2004, which was about $6,580. Below will give you a better estimate of some of the costs of a funeral courtesy of the NFDA. Please keep in mind these figures are just estimates of the bare minimum and do not include the cost of cemetery, flowers, obituaries or crematory fees. On average in the last 10 years the cost of a funeral increase roughly 30%.

On top of the previously mentioned costs, there are other bills that also need to be considered. Any outstanding bill that has been left by the individual who has passed still needs to be taken care of. These additional costs are often overlooked by families. But a burial insurance policy could be used, to address these:

Credit card debt

Medical bills

Travel expenses for out of town relatives to attend the funeral

Utility bills

Transportation of body

Income loss

These items, if not accounted for can add up quickly. Best-case scenario is that the policy you purchase is able to cover all of your funeral costs as well as any outstanding bills upon your passing. Some individuals run into a budgetary problem that will not allow them the coverage they necessarily want. Pro Tip: buy what you can afford. A comfortable monthly payment is your best option. If you are unable to pay your monthly payments, the insurance is no longer good to you as well

What is a Burial Insurance Policy? The easiest way to describe it is always a simplified issue whole life insurance policy. The simplified portion meaning you will not have to take a physical or medical exam to qualify. Applications are 3-5 pages, and underwriting decisions are made in a matter of minutes, or days. Not weeks or months.

The policy can be summed by not expiring, the monthly payment cannot increase for any reason and the death benefit cannot decrease for any reason. This permanent whole life policy will cover you complete life, and will provide peace of mind to your family, knowing that insurance is in place, to address your final expenses.

Super simple! Whenever you may pass your beneficiary will be cut a lump sum, tax-free check from your insurer. No strings attached. Relieving your loved ones of any financial burdens that may come with the additional funeral costs.

Not only that but if there are any leftover funds, they will not be given to the funeral home. They will stay with your designated beneficiary to do with what they see fit. Many people will want to have additional insurance money, to address all of these other types of final expenses.

As much as we wish it weren’t true, there are companies out there willing to make a dime off of the expense of your death. Many companies like to ‘prey’ on the Senior Market place. As long as you are aware to the possibility, they are easy to spot.

Some companies will try and sell you temporary life insurance plans without being truthful up front. They may also have policies that have increasing premiums, or even possibly sell a policy to you, that expires at a certain age. Any policy that has you thinking it is too good to be true usually is. Trust your gut. These policies will tend to cost less per month but tend to expire at a certain age.

AARP and Globe Life are two companies that have been known to try and bamboozle you with the lower rate. Although they market temporary life insurance plans for individuals looking for burial insurance, these plans tend to come with an expiration date. Often times, their policies will have premiums, that increase as you get older. These age-band rates, effect everyone within specified age brackets. Most clients prefer policies that have guaranteed premiums.

AARP and Globe Life are two companies that have been known to try and bamboozle you with the lower rate. Although they market temporary life insurance plans for individuals looking for burial insurance, these plans tend to come with an expiration date. Often times, their policies will have premiums, that increase as you get older. These age-band rates, effect everyone within specified age brackets. Most clients prefer policies that have guaranteed premiums.

Some of their policies will expire at let’s say age 80, or age 85. Meaning, you will no longer receive any benefits. It would be one thing if you were not planning to live past 80, but if you are… I would look elsewhere.

If you receive an offer thru the mail, generally it will not be in your best interest. Or if you see a TV commercial, from Colonial Penn, it’s important to know the exact plan, they are advertising. We recommend that you always with speak with an agent, verbally, and have them explain to you all of your burial insurance options.

Our top three final expense companies that really stand out from the rest for people over age 80 are Mutual of Omaha, AETNA, and Royal Neighbors of America. Across the market, these three companies have competitive policies for seniors over 80, friendly underwriting, and provide great customer Service.

Mutual of Omaha, also known as United of Omaha, is a top tier company. No matter what age you are, they have a policy that will definitely show you some of the best prices in the market. For individuals in the 80-85 age bracket, this especially stands true. As long as you are in good health you will be able to qualify for some of the lowest cost burial insurance you can find. Mutual of Omaha offers fair underwriting guidelines, and their product may be a good fit for you.

Royal Neighbors of America would be our second pick. As a company that has been around for over 130 years they have some of the best reviews out there. Their underwriting is known to be extremely relaxed with almost unbeatable pricing on burial insurance for seniors 80 years or older. However, they cut off age for issuing a policy, is age 85. Royal Neighbors of America offers a great policy, and they provide wonderful customer service. In our opinion, they offer one of the best senior insurance products in the country.

AETNA is an insurance company that you’ve probably heard of. They provide multiple products to the senior market place. AETNA will offer a burial insurance policy, thru age 89. However, they are not available in every state. Depending on where you live, you may or may not have this option. Many seniors over age 80, have enjoyed having their final expense insurance product.

Unfortunately, as we get older, our health tends to decline. If you can’t qualify for policies that pay an immediate death benefit, you may want to consider guaranteed issue plans , as they may be your only choice.

These are permanent whole life insurance policies, but they have a two year waiting period on paying the full death benefit. Guaranteed acceptance policies are designed for people who are not in the best overall earth. If death occurs in first two years, all premiums plus 10 percent interest is paid to the beneficiary. After two years, then full amount of policy is paid, to the beneficiary at time of death.

Two of the most popular guaranteed issued policies are Gerber Life Insurance Company, and AIG. Gerber Life will offer coverage to people thru age 80, while AIG will provide plans to people thru age 85

The biggest problem seniors over 80 run into when finding the best burial insurance is dealing with their health issues. By the time your 80 the likelihood you have dealt with some type of serious issue is pretty high.

When looking for the best burial insurance for seniors over 80 we need to keep in mind types of health issues because some insurance companies will charge you’re a higher premium if you take certain prescriptions. We will start by making a list of any prescriptions or health issues you may have and find the best life insurance companies out there that don’t have any issues with those medications. Once that’s out of the way we will be able to select the cheapest option that will best suit your needs. Allow us to do the heavy lifting. You simply need to communicate with us, share us some brief health details, and from there we can share with you the plans, and companies, that you will qualify for.

Keep in mind that your burial insurance will never be cheaper than it is today. The sooner you have it the sooner you’ll appreciate it. All the more reason to contact Burial Insurance Pro’s! Our agents are always happy to assist you, with your senior insurance needs.

We have helped find burial insurance for seniors over 80 and get them the coverage they need at a price that is affordable. We know your options and we help you sort through them – answering any questions you may have along the way. You are not in this alone.