Mutual of Omaha

By Matt Schmidt

As a consumer, you are looking for information on Mutual of Omaha’s burial insurance policy. Good news! You came to the right place. This article will discuss the pro’s and con’s of the Mutual of Omaha final expense policy.

In this article, we’ll cover the sample rates, qualifying health questions, and product details. IF you don’t want to read this article, simply request a quote or call us at 844-334-6143. A licensed agent is more than happy to discuss the Mutual of Omaha burial insurance product.

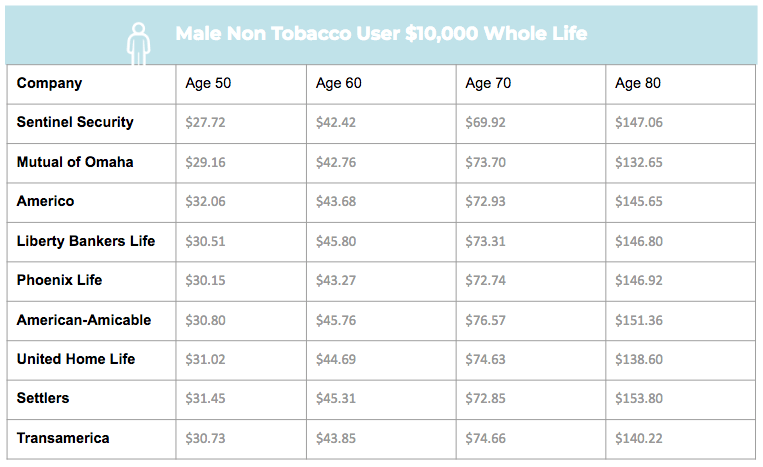

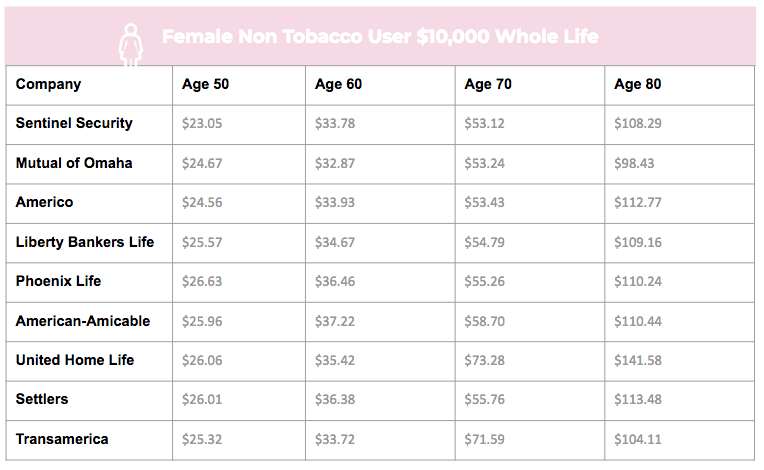

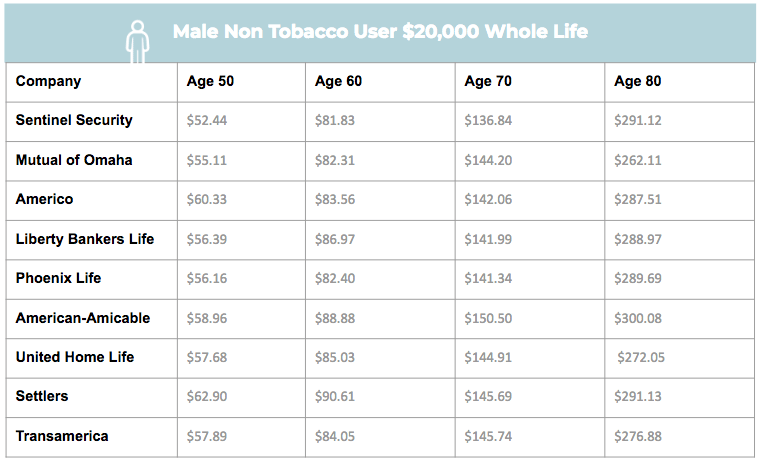

We’ll note that the Mutual of Omaha burial insurance policy is very popular, and for many people it’s a great option. However, in some situations Mutual of Omaha is simply not the best fit. This is why we encourage you to speak with an agent, share with them your unique situation, and let us help you determine the best burial insurance company possible.

Company Background: Mutual of Omaha has one of the more well-known Burial Insurance Plans in North America. Founded in 1909 as Mutual Benefit Health & Accident Association, they now provide a slew of products that include banking, and financial commodities, health insurance options, and of course life insurance for funeral expenses. After more than a century in the insurance business, they have assets and reserves totaling billions of dollars and have received “A” (superior) ratings from major insurance rating services.

If you do not want to read this entire article, please simply complete an online quote request. Or call us directly, to speak with an agent to discuss your eligibility for the Mutual of Omaha burial insurance product. Our phone number is 844-334-6143.

Mutual of Omaha’s simplified issue whole life insurance policy is referred to as their Living Promise product. This is the main product that they market to consumers, as a burial insurance policy.

All life insurance, including their final expense insurance products, are offered through United of Omaha. Please don’t let this confuse you! United of Omaha offers all types of insurance products. IN this article, we are going to focus on their final expense insurance product.

This burial insurance product, also known as Mutual of Omaha final expense life insurance, or whole life through its subsidiary United of Omaha. This policy is called the Living Promise Whole Life Insurance plan and is designed to pay for someone’s final expenses, as well as any other costs that are associated with the end of an individual’s life. If a family member could incur some financial hardship, this policy would be there for the insured’s family and/or survivors.

At the time of the insured’s death, the named beneficiary would receive the death benefit from Mutual of Omaha. This lump sum, tax free payment, can be used however the beneficiary sees fit. There are no restrictions on how this death benefit can be used. Because of this, their burial insurance policy is one of the best ways to address final expenses.

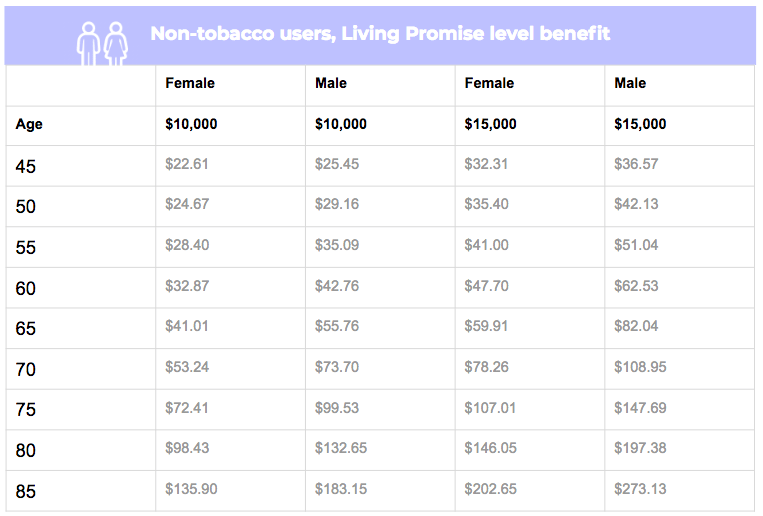

The Level Benefit Living Promise Mutual of Omaha Burial Insurance Plan is offered to those who are between the ages of 45 and 85. The face amount or death benefit that may be collected can range between $2,000 up to $40,000. This is an excellent final expense option because you will be covered on the very first day of the plan. This burial insurance plan is one of the best-priced in the industry. If you can qualify and don’t mind answering a few health questions, you should consider it! The Mutual of Omaha burial insurance level plan is incredibly competitive for people ages 80-85 as well.

This popular burial plan does provide some additional riders, at no extra cost to you. These riders are not available in all states. A licensed agent can determine if these features are available to you.

You are under no obligation to ever utilize these riders. However, many families can benefit by having flexibility with their Mutual of Omaha policy.

‘The Graded Benefit Plan’

The Mutual of Omaha Graded Benefit Burial Life Insurance Plan is offered to those between the ages of 45 and 80. With death benefits that range between $2,000 and $20,000 in burial insurance protection. This policy provides a graded benefit, which means that if death occurs during the first two years of having coverage, the beneficiary will be reimbursed the premiums paid and 10% interest, not the face amount of the burial insurance plan. Once you’ve had the plan for two years, the full amount of the burial insurance plan will pay out to the beneficiary, regardless of the cause of death of the insured.

(This policy is not available in AR, MT, NC, or WA).

For many people, it may make more sense to inquire into Mutual of Omaha’s ‘guaranteed acceptance’ policy. This policy cannot be bought from us, or other independent agent. You’d have to contact Mutual of Omaha directly, for information and quotes. We do want to point out that only a person in below average health would want to consider a ‘guaranteed acceptance’ policy. In our opinion, there’s no reason to pay more for a burial insurance policy, and not have an immediate death benefit.

To determine which Plan you qualify for, you must fill out an application. You will be the primary source of information so your answers on the form will be the most critical part of the application process.

Applications can be completed over the phone, through email, or you can receive an application in the mail. However, you must speak with an agent verbally at SOME POINT to go over the health history questions. Mutual of Omaha requires that an agent verbally ask these questions.

Mutual of Omaha’s funeral insurance policy has two sets of health questions on the application. The first set of health questions are known as knockout questions; answer yes to any of these questions and you’ll automatically be disqualified. You will not be eligible for any policy from Mutual of Omaha if you have any of the knockout health conditions.

Generally, applicants find the wording of the application confusing. Be sure to take your time and speak with a Burial Insurance specialist to verify your eligibility.

The second part of the application questions is for the graded plan. If you answer yes to any of these conditions, you will be approved, but only for the Graded Benefit Burial Insurance Plan.

Are you currently:

Have you ever had or been diagnosed with or treated for:

In the last 12 months have you been:

In the last 2 years:

Have you ever been diagnosed with, treated for, or been advised to seek treatment for:

In the last 4 years have you been diagnosed with, treated for, or been advised to seek treatment for:

In the last 24 months have you been diagnosed with, treated for, or been advised to seek treatment for:

In the prior 24 months have you:

In the past 12 months:

Mutual of Omaha will use four ways to qualify you for their Burial Insurance Plan:

These categories are the standard for most burial insurance plans. It’s very rare to find any burial insurance plan that does not use these to determine your qualification. We do NOT know of ANY insurance company who would offer coverage without asking health questions, and doing a prescription background review.

Mutual of Omaha is known to do “random” phone interviews with applicants, and cannot be done by next of kin or family members. When selected for the interview, you will have to answer all health questions on a recorded line. If they want more information regarding what they find in your MIB or Prescription check, they will ask about that as well. Sometimes they ask follow up questions regarding information they find out during the interview process. Don’t be nervous, this is all very normal and routine. Once all requirements are met, an underwriting decision can be made in two to three days. Or, if you complete their electronic application, you may receive a decision in a matter of minutes.

One of the best parts about Mutual of Omaha’s final expense insurance plan is how easy it is to understand. There is no fine print you will need to be aware of. Once you get a Burial Insurance policy it will remain in force as long as you live and make premium payments. If you consistently make your monthly payments, you will have peace of mind knowing that it will always be there for you and your family.

A Burial Insurance specialist will be able to further assist you in choosing the Mutual of Omaha burial insurance policy that works best for you and your loved ones. They will be able to explain the costs and the available plan helping you achieve peace of mind. Should you discover that you have any questions at all regarding the burial insurance policies from Mutual of Omaha – or if you have questions about life insurance in general – contact us. Our experts are here to assist you with obtaining quotes, as well as with other needs, such as determining how much burial insurance you will need, what type of coverage will fit your needs the best, and which of the many life insurance carriers will be the best for you.

Q: Are Mutual of Omaha and United of Omaha the same?

The name Mutual of Omaha has been utilized by the corporation since 1981. All shares of United of Omaha Life are now owned by the Mutual of Omaha Insurance Company.

Q: Does Mutual of Omaha require a medical exam?

With the Mutual of Omaha Living Promise product, you do not need to have a medical exam to qualify. Not to mention, most applications are approved in a matter of days.

Q: What does Mutual of Omaha insurance cover?

Since the coverage offered is essentially whole life insurance with minimal underwriting, when redeemed your successors will receive a tax-free , lump sum payment for the amount of coverage you purchased to cover any end-of-life costs that may arise.

Q: What type of life insurance policy, does Mutual of Omaha offer?

These policies are whole life insurance policies. In our opinion, these types of policies are the best type of policy, to address burial costs, and funeral expenses. Rates do not increase, and the policy is designed to cover a person’s entire life.

Q: What is the application process?

Mutual of Omaha’s application process is simple. You’ll complete an application with your agent over the phone, through email, or even through the mail if necessary. Once the application is received back by your agent, it is submitted to Mutual of Omaha. The underwriting department then will process, and review. If a phone interview is needed, your agent will contact you and provide you the phone number to call into.

Mutual of Omaha Company Background

Home Office Phone #: 1-800-377-9000

Company Webpage: www.Mutualofomaha.com

Age Availability: 45-85

Face Amount Range: $2,000-$40,000

2 Year Waiting Period: No (subject to underwriting approval)

Eligible states: All States Except NY

Now, I bet you may be wondering, is Mutual of Omaha a financially solvent company? We can comfortably say YES. Let’s take a look at some of their ratings.

Many of our clients feel very secure knowing that their burial insurance coverage is underwritten by Mutual of Omaha. We too can sleep well at night knowing that Mutual of Omaha will be around for years to come.

Mutual of Omaha also offers several other insurance products such as:

A Burial Insurance specialist will be able to further assist you in choosing the Mutual of Omaha Insurance policy that works best for you and your loved ones. They will be able to explain the costs and the available plan helping you achieve peace of mind. Should you discover that you have any questions at all regarding the burial insurance policies from Mutual of Omaha – or if you have questions about life insurance at all – please contact us. Our experts are here to assist you with obtaining quotes, as well as with other needs, such as determining how much burial insurance you will need, what type of coverage will fit your needs the best, and which of the many life insurance carriers will be the best for you.

If you’re looking for burial insurance that’s cost-effective and suits your needs, look no further. That’s what we do and what we excel in. With years of experience in the industry, we provide our customers with the peace of mind they need while finding the best plan.

If you want the expert opinion from a Burial Insurance pro, fill out the quote form or give us a call at 844-334-6143.

At Burial Insurance Pro’s, we have the knowledge and experience to help you find a suitable plan that’s right for you. We know the ins and outs of finding the best policies out there. Don’t waste your time, let us take care of your questions, thoughts, and concerns when it comes to any company you may be looking into for your insurance needs.

In the event that Mutual of Omaha wouldn’t be the best company for your personal situation, we’ll advise you of this. Maybe another company like Lincoln Heritage, Sentinel Security, or maybe Gerber Life Insurance are more appropriate. We’ll be 100% honest with you.

Let us help you make solid recommendations that are tailored to you and your lifestyle. We know your options, and we help you sort through them – answering any questions you may have along the way. Contact us today to get started! We’d love to earn your business.