Burial Insurance Options for the Blind

By Matt Schmidt

Last Updated on February 24, 2026 by Matt Schmidt

Do you have a loved one who is blind? I’m sure they are under the inclination, like many other individuals who are blind that finding burial insurance is near impossible. We are here to tell you it’s not! We will be honest with you; there are a lot of companies out there that shy away from insuring blind applicants. There are even companies out there that actually will refuse your application. It’s unfortunate that companies like this are even out there, but at Burial Insurance Pro’s we can help you find a company that will gladly accept your application for burial insurance.

The Facts

Finding burial insurance for individuals who are blind isn’t easy. It can be downright frustrating at times to find companies who are limited and unable to help individuals who cannot see. Being blind shouldn’t hinder you from finding affordable health insurance without a waiting period. A lot of companies out there impose penalties for individuals who are blind, which is extremely unfortunate.

Funeral life insurance is done on a simplified term, meaning there is no medical exam or any paperwork that you need to fill out. With modern technology, you are able to now just call in and apply which helps blind individuals avoid all the hassles that have been imposed on them from the past.

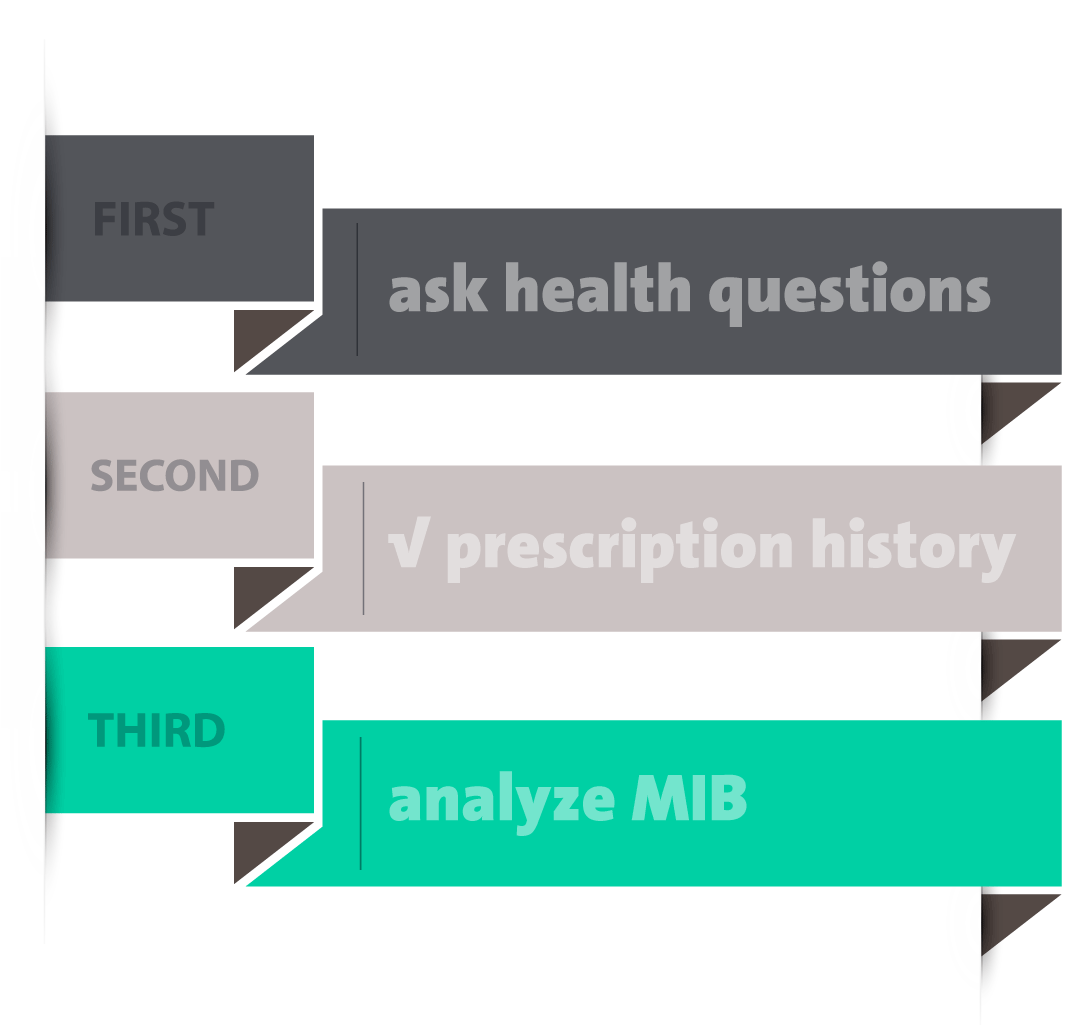

Underwriting for Blindness

Underwriting is the primary process for insurance companies. This process evaluates all your information and decides what type of risk you are to the company and if your risk would be worth it. When it comes to burial insurance plans the underwriting process usually consists of the 3 steps. First, they will ask you all about your health. Once they get that information they will check your prescription history to see what type of medications you use. Finishing with taking a look into your MIB for any relevant records. This will help them take a deeper look into your health history. Neither your prescription history nor MIB file should come into play when applying for burial insurance when you are blind.

Why do they look into all of this stuff? It’s pretty simple; they want to see if you would be considered a good or bad health risk to the company. If you’re considered a bad risk to the company, your eligibility will be declined. There are actually some companies out there that skip the underwriting process completely!

Health Questions are the Key

When it comes down to the brass tax, you’re going to either be eligible for insurance with a certain company based upon your answers to their health questions.

The general rule of thumb is if there are no questions about a certain health issue, then that company is okay with it. However, on the other end of the spectrum… if you answer “yes” to any of the health questions it doesn’t necessarily mean you are completely out of luck. It may mean that you will have to pay a higher monthly premium or a possible modified payout of benefits in the first few years. Let us help you shop around and find a company that will cause the least amount of issues based upon your pre-existing conditions.

Is Blindness a Health Question?

Is Blindness a Health Question?

No. Funeral insurance companies will not ask about blindness directly in their health questions. So you’re blind and you’re in the clear right? Not necessarily. Where they will get you is asking about questions about “needing assistance with daily activities” or “do you have home health care”. If you can honestly answer ‘no’ to either of those questions then you’re in the clear, but those individuals come few and far between. For those individuals who answered ‘yes’ unfortunately you will be declined.

Being Blind and Totally Independent: If you deal with lack of vision you shouldn’t have any trouble picking an insurance company. You are considered a ‘low risk’ and there is no reason why any of the final expense life insurance companies wouldn’t accept you. Allowing you to qualify for instance coverage at a low rate. Wins all around!

Being Blind and Needing Assistance: So you answered yes to one of the health questions and were declined coverage for final expense life insurance. Deep breathe. It’s ok! We can help! We work with a few companies that offer final expense insurance WITHOUT asking any health questions. You can obtain coverage just as easily as someone with 50/50 vision. Although your options aren’t as great you have two routes you can take:

Royal Neighbors of America is the only company that will work with you to obtain immediate coverage while getting their lowest rates. You won’t be subject to any penalties either. If you do not qualify for Royal Neighbors of America because of one of their other health questions your only other option is to take out a guaranteed issue policy. There is no underwriting process for guaranteed issue policy, which is why you would qualify. The downfall of these types of policies are the premiums are extremely high and there is a two year waiting period. The three best companies we would recommend for guaranteed issue policies are Gerber Life, AIG, and Mutual of Omaha. Depending on our age will help us determine which company would be the best (cheapest) option for you.

What Next?

Leave the heavy lifting to us. That’s what we are here for! When it comes down to it, it doesn’t matter what type of health issues you have, we will be able to find the best policy for you because we have the knowledge and understanding of what it takes to get the lowest cost final expense policies. These policies can only be sold through agents and agencies like us!

Enlisting the help of a qualified independent agency, that represents lots of different insurance companies will help you find the perfect fit for you and your health/medical needs. The best part about independent agencies is that they aren’t married to one insurance company, so they will be able to find you the best deal out there!

We have helped many people find the coverage they need at a price that is affordable. We know your options and we help you sort through them – answering any questions you may have along the way. You are not in this alone.

Contact us today to get started!