What Type of Policy is Best for Burial Insurance?

By Matt Schmidt

Last Updated on February 24, 2026 by Matt Schmidt

Understanding the basics of burial insurance doesn’t have to be difficult. But since you don’t spend your days working in the insurance industry, you may easily get confused by all the different types of policies and options that you encounter when seeking a policy for yourself to cover burial costs and final expenses.

There are countless Television commercials that talk about policies for Seniors, but what exactly is the fine print they are showing but not describing? You know you need this burial insurance to cover these end-of-life expenses, but what kind do you need? And how much of policy do you choose?

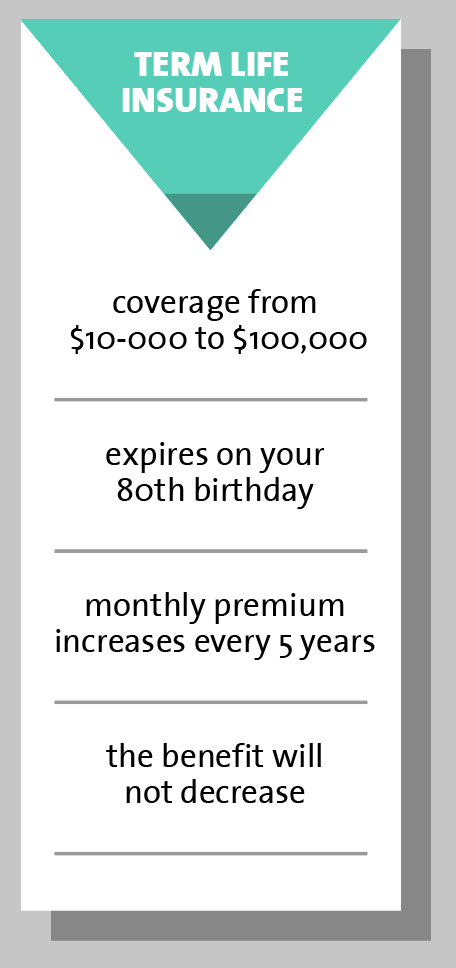

Below are some sample types of policies, that various insurance companies advertise to Seniors.

Leave the confusion in the past because today we are going to give you all the information you could want in regard to the types of insurance policies you can seek for burial expenses. We’ve got you covered with the good, the bad, and all the informative tips in between.

First and foremost, why would you want to buy a burial insurance plan to cover your final, end-of-life expenses? When you die, your loved ones will be left with the responsibility of clearing up your financial obligations and handling your burial and funeral arrangements. It will likely cost quite a bit to handle these. This is where burial insurance comes in to play.

Upon your death, whatever type of life insurance policy you have will pay out a death benefit payment to your beneficiary. Depending on how much your policy is for, that money can be used to pay your funeral expenses and clear up any other unfinished business. There is no specific rule for what the money is used for – so choose a beneficiary that you can trust to take care of your end-of-life expenses.

Also, certain final expenses insurance carriers will allow you to assign your policy, to a funeral home. Upon death, the life insurance company pays the death benefit to the listed funeral home. Any remaining money left over from the services performed will then be paid back to the family.

The death of a loved one can be a grief-filled experience and can cause a lot of stress on those left behind. Combine the grief with financial hardship, and the entire situation becomes amplified. Don’t leave your family is despair – be sure to purchase a burial insurance plan policy at a minimum.

Everyone’s final wishes are different, and the amount of coverage varies from individual to individual. According to SmartAsset.com, the average funeral cost is over $7000. This doesn’t include the cost of any other types of expenses such as credit card debt, medical expenses, etc.

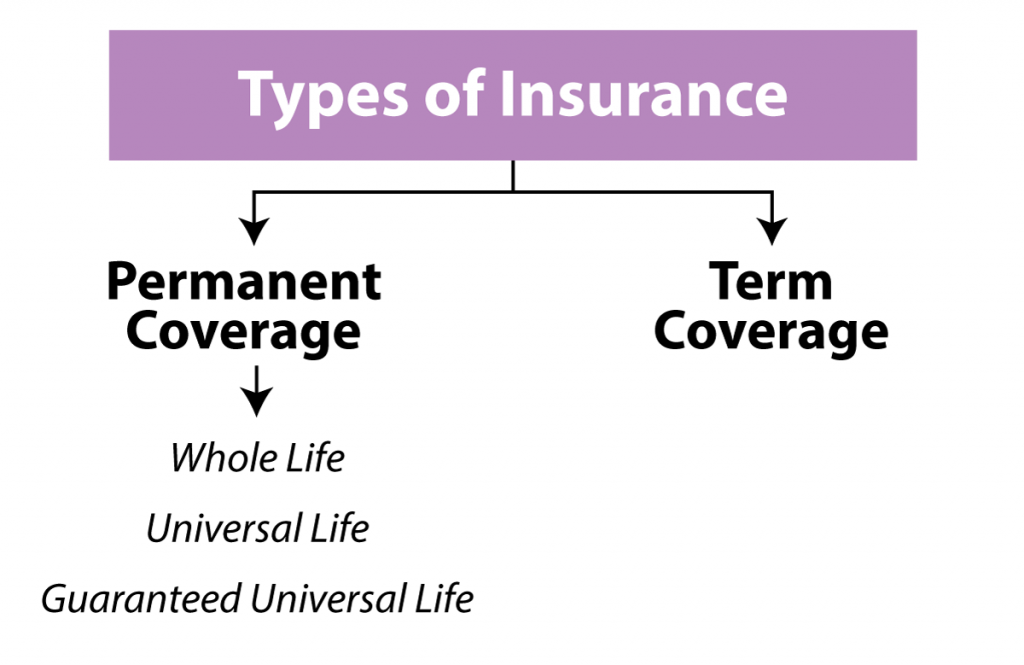

Primary Types of Life Insurance

If you have tried to learn anything about life insurance, you probably know by now that you can’t lump all life insurance into the same category. Each type differs. However, there are two main types that you will encounter:

Learning about the pros and cons of each can help you choose the best policy for your needs.

Learning about the pros and cons of each can help you choose the best policy for your needs.

Universal Life Insurance

If you could mix two policies together to create a new one, then universal life insurance would be the offspring of term life and whole life. Unlike term policies, universal life insurance policies can be permanent, rather than temporary or for a set period of time. The key factor that sets this type of life insurance apart from the others is the risk level for the individual – rather than the usual risk to the company. Because, without managing the account properly, you can find yourself in some hot water.

Here is how:

Universal life policies cost less than normal whole life insurance policies. And, your monthly premiums never increase. While this may sound great, it can backfire over time. See, your monthly payment may remain the same, but that doesn’t mean that the cost of insurance doesn’t increase.

So, as long as an individual is making payments, he or she is able to add additional monies to the payments – and this additional money goes toward the cash value of the policy. Then, with the interest that is earned (with either the minimum guaranteed interest growth rate or a speculative interest rate) on these contributions, the overall cash value will grow.

Unfortunately, these universal life policies become risky when the cost of the insurance rises, but your payments do not. If you choose to not add additional funds to your monthly premium, the insurance company will start dipping into your cash flow account for the payment. In fact, over time, your cash flow account could reach a balance of $0.00. And, when it comes time for you to need to money, you may actually receive a cash payout that is less than what the policy was worth to begin with.

As far as underwriting for universal life policies, there are some restrictions, but even those with some run-of-the-mill health issues can still qualify for coverage.

The lowdown: Unless you can always afford to make payments that will never have you dipping into your cash value account, take caution with universal life insurance. Also, if you choose to surrender the policy at some point in the future, there’s no guarantee to the cash value of the policy.

Guaranteed Universal Life Insurance

Unlike regular universal life insurance, guaranteed universal life insurance has minimal cash flow account. However, the idea behind this type of policy is to pay enough each month to cover the cost of insurance. As long as you do that, your policy will remain in effect. Policies are designed, for premiums to remain level thru age 90, 95, and age 100. If you live beyond age 100, the majority of policies will no longer require premium payments.

Unlike regular universal life insurance, guaranteed universal life insurance has minimal cash flow account. However, the idea behind this type of policy is to pay enough each month to cover the cost of insurance. As long as you do that, your policy will remain in effect. Policies are designed, for premiums to remain level thru age 90, 95, and age 100. If you live beyond age 100, the majority of policies will no longer require premium payments.

Missing a payment, falling victim to a banking error, or mis-budgeting your accounts can land you in some super-hot water. Not only are you then at risk of losing your coverage, but your monthly premium rate will also likely increase – drastically.

When it comes to the underwriting of guaranteed universal life insurance policies, there is quite a bit of risk (since the premiums are usually lower than the cost of insurance). There are only a few different companies who will offer lower amounts of coverage, and $25,000 is usually the minimum amount. If needing only $10,000 of insurance it may be tough to locate a company to accommodate.

Finding a non medical exam guaranteed universal life insurance policy can be difficult too. Majority of carriers require a blood and urine test, and may also require a review of your most recent medical records. However, we know a few different companies who may offer coverage, depending on your overall health, and age.

If you have health-related issues that are relatively minor, qualifying for coverage should not be a problem. However, if you have had a history of cancer, heart attacks, strokes, and other major medical issues, finding a competitively priced policy could be a challenge.

The lowdown: If you do well at managing money and pride yourself on this, then guaranteed universal life insurance could be a great policy for you.

Term Life Insurance

Term life insurance is only for a set term, such as 1, 5, 10, 20, or 30 years – or until you reach a specific age. And then it is no longer valid, and you get nothing back from it. In other words, it is a temporary form of life insurance. The downfall is that if you are getting up there in age and your term life insurance expires, you may find it impossible to obtain another policy due to your age or overall health.

Because insurance companies who sell term life insurance are banking on the fact that you will outlive your policy, it is common for their underwriters to be more selective and strict with who they allow to purchase. Term insurance underwriting guidelines will be stricter than other forms of burial or whole life insurance.

Term insurance is less expensive then forms of permanent insurance. However, since a person generally does not know when they’ll pass away, we would never recommend a plan like this. We prefer to place our clients with a final expense insurance policy that will pay out a death benefit, no matter when a person passes away

The lowdown: term life insurance policies can be hard to obtain by people in their 70’s and 80’s. Not all insurance companies will offer term plans at that age. Also, if only wanting $10,000 to $15,000 of coverage, not all carriers will offer that low amount of coverage. You also need to be aware that some companies will have increasing rates every 3-5 years. Please avoid companies that do not have guaranteed premiums, for the duration of the life insurance policy.

Burial/Funeral Insurance or Final Expense Insurance

The three terms above are often used interchangeably. They reference a type of whole life insurance that is used primarily for covering the expenses used for costs associated with funerals or burials. Most companies who offer these types of simplified issued coverage, limit the amount of coverage to $50,000 or less per insured.

So, why would someone choose to go with a final expense whole life insurance policy?

The lowdown: Final expense insurance is a sure thing when it comes to needing a small policy to cover end-of-life expenses without much hassle. The convenient underwriting process is usually idea, for Seniors or for people who don’t want to complete a medical exam.

Finding The Best Fit For You

Now that you know all about the types of insurance policies and how they can help you with your burial expense insurance, it is time to choose the one that is the best fit for you.

Consider your answers to these questions to help single out the best policy for your needs.

Consider your answers to these questions to help single out the best policy for your needs.

Hear it From the Experts

There are many reasons why you should or shouldn’t choose a policy. Be sure to talk to an independent insurance agent to discuss what your best option is. Everyone has different goals with the coverage they are seeking. An agent would be able to help with choosing the right type of policy and help you choose the best company for your situation.

If you are like most individuals, you probably don’t want to spend a lot of time focused on your life insurance policy. You also likely want to feel confident that your loved ones are going to be taken care of should pass away. Therefore, you want a policy that you can count on. You want it to be there when you need it – and in the way you planned for it.

If you are like most individuals, you probably don’t want to spend a lot of time focused on your life insurance policy. You also likely want to feel confident that your loved ones are going to be taken care of should pass away. Therefore, you want a policy that you can count on. You want it to be there when you need it – and in the way you planned for it.

For all of these reasons, burial whole life insurance may be your best-case scenario. This policy won’t expire, the monthly premiums do not increase, and the death benefit will never decrease. Because they plan for the risk, even those with serious medical issues will likely qualify. If you don’t qualify for an immediate death benefit policy, you’d be eligible for a guaranteed issue life insurance policy.

Clarity and Conclusions

Once you are ready to purchase your burial insurance policy, you will want to know exactly everything you are looking for.

To get the best rates and to find the best companies, be sure to contact us at Burial Insurance Pro’s, who is knowledgeable and has a wide network of potential companies. They understand the ins and outs of the business and know which companies offer the exact services you are looking for.

Don’t waste your time trying to go it alone – even though you may be feeling like an expert at this point. The world of insurance is tough and confusing. And, let’s face it – making sure that your loved ones are taken care of at the end of your life is nothing to take lightly. The knowledge and experience of your independent agent are there to guide you. Use it!

Just Call us at 800-470-0179, and have a quick 5-minute initial consultation. An agent can find out more about your needs and can assist with making proper recommendations based on your financial objections. Here at Burial Insurance Pro’s, we love working with families all across the United States.