Burial Insurance for Seniors over 70

By Matt Schmidt

Last Updated on February 24, 2026 by Matt Schmidt

You’ve just turned the big SEVEN-O, you can finally sit back and relax… enjoy the finer things in life. Your kids are finally adults, they have kids of their own (who you love to spoil) you can finally take a deep breath and just enjoy life’s simple pleasures.

You worked extremely hard to get to this point in your life. It took you a while but you made a plan for your future and executed it flawlessly. Some individuals would stop here, but there needs to be a little bit more planning before you can coast into the sunset.

The biggest thing we tell clients about burial insurance is… DON’T PUT IT OFF!

Time and time again we find individuals coming to us in need of final expense life insurance. Other companies have told them that it’s nearly impossible to find life insurance due to their age. We are here to let you know, that is not true and we are here to help!

Not only are there tons of burial insurance companies out there that issue to individuals 70 years old or younger but also the coverage they offer goes into effect immediately. As in there is no waiting period. None!

The time is now. Now is the best time to plan on obtaining burial insurance to ensure your final expenses are taken care of and your premiums stay low. Keep in mind that your burial insurance will never be cheaper than it is today. The sooner you have it the sooner you’ll appreciate it. Don’t wait until your 80 when those prices are exponentially more.

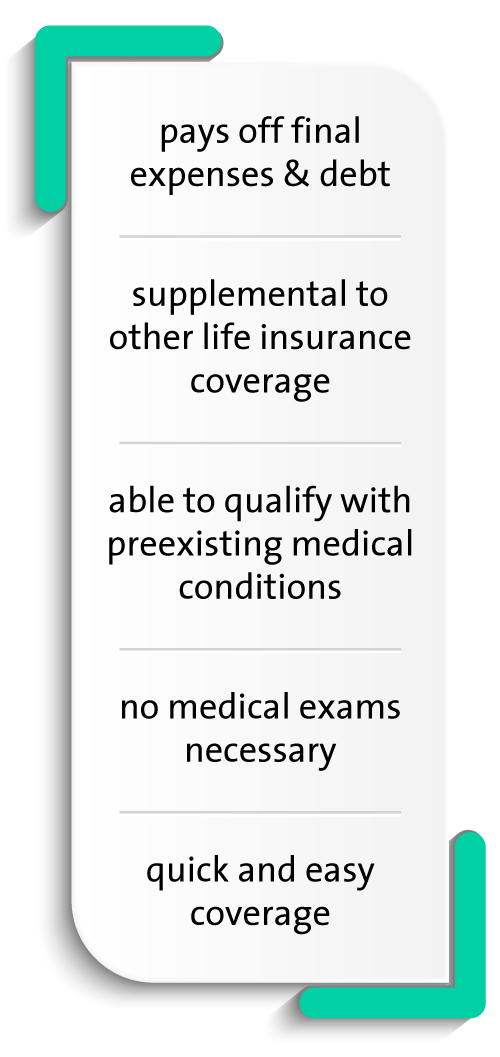

There are many reasons that an individual should consider final expense life insurance. One of the primary reasons to consider the purchase of a final expense life insurance policy is so that there will be funds available for paying off the insured’s funeral and other related expenses. In some cases, an individual will even purchase an additional amount of final expense coverage so that their loved ones can also pay off any additional debt, such as uninsured final medical bills and/or the cost of hospice care.

Even if a person already has other life insurance in force, these policies may be earmarked for other needs, such as paying off a mortgage or providing a surviving spouse with ongoing retirement income. Having an additional policy that is dedicated solely to paying off final expenses, then, can be smart financial planning. Oftentimes, due to its lower face amount of coverage, final expense insurance will be very affordable. These types of policies will also allow you to rest easy knowing your family has been taken care of and not stuck with any outstanding debt or issues.

Looking for burial insurance can be confusing. You do searches and find companies saying that they have the “Best Price” but then two seconds later you’ll find another company saying their prices “Can’t be beat!” well they both can’t be the best? How do you really know who is offering you the best bang for your buck?

That’s where we come in. We will let you in on our little secret, there are really only two things you need to keep in mind when searching for burial life insurance. It’s simple, we’ll share with you how to:

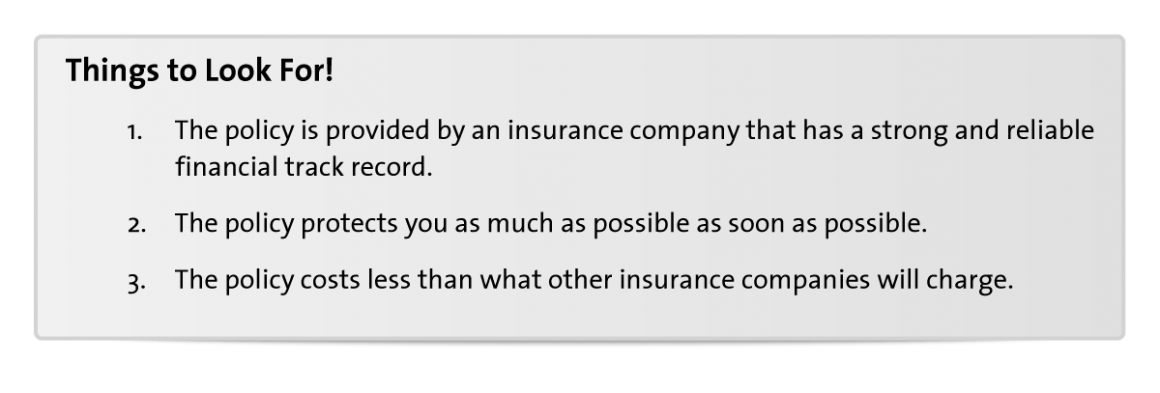

Step 1: Spot the Best Final Expense Policy Sounds simple? Well it really is. You want to find an insurance company that is fiscally stable because a policy is only as good as the insurer’s ability to pay their claims. You want the policy to start protecting you ASAP! Why would you want to have to wait a few years before the company starts to pay its claims? That’s because you don’t! Lastly, you want those premiums to be as low as they can possibly be. The lower they are, the more money in your pocket to spend on other things you may want… like that sports car you always had your eyes on.

Sounds simple? Well it really is. You want to find an insurance company that is fiscally stable because a policy is only as good as the insurer’s ability to pay their claims. You want the policy to start protecting you ASAP! Why would you want to have to wait a few years before the company starts to pay its claims? That’s because you don’t! Lastly, you want those premiums to be as low as they can possibly be. The lower they are, the more money in your pocket to spend on other things you may want… like that sports car you always had your eyes on.

Step 2: How to Find the Best Plan for You

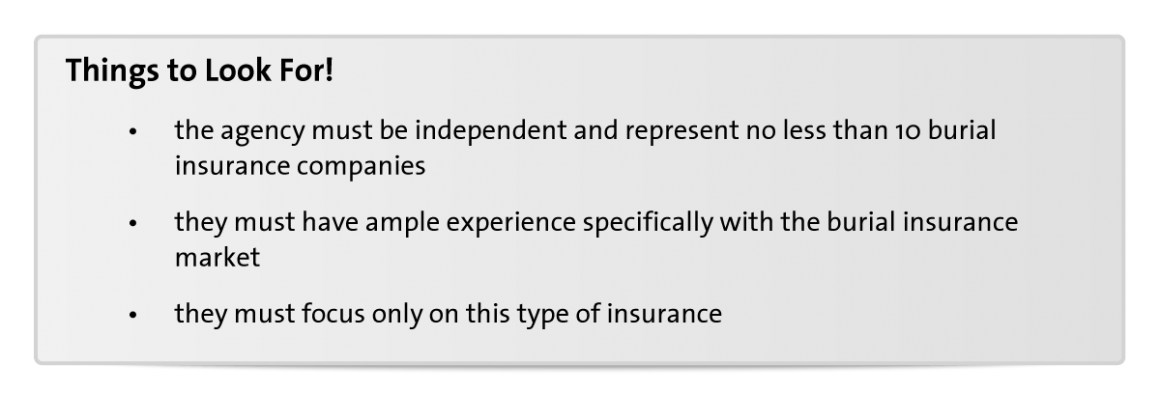

This may seem like we are tooting our own horns, but the best way to find the absolute best plan for you is to hire an independent broker agency that specializes in final expense life insurance. Now you don’t have to hire us (although we would love if you did) but you should keep your eyes open for the following things when looking into different agencies.

The biggest reason to work with a broker is that we will do all the heavy lifting for you. You won’t have to personally call 10-20 companies looking for the best deal. We’ve found that these calls can sometimes take upwards to 4 hours to complete! Not only do we work with all the companies you most likely will try to call, but we already have all the information you were looking for to begin with. Don’t waste your time on the phone. Go out and enjoy a nice dinner while we compile all the information you’ll need to pick your best burial insurance plan!

We will be able to find the best policy for you because we have the knowledge and understanding of what it takes to get the lowest cost final expense policies. Also, a lot of the insurance agencies our there will not sell directly to you. These policies can only be sold through agents and agencies like us!

Keep in mind that your burial insurance will never be cheaper than it is today. The sooner you have it the sooner you’ll appreciate it. All the more reason to contact Burial Insurance Pro’s!

Enlisting the help of a qualified independent agency, that represents lots of different insurance companies will help you find the perfect fit to you and your health/medical needs. The best part about working with an independent agency like us is we are not tied to just one insurance company! We will be able to put in the time and research to find you the best deal out there!

We have helped many people find the coverage they need at a price that is affordable. We know your options and we help you sort through them – answering any questions you may have along the way. You are not in this alone.

Contact us today to get started!