Secrets To Buying Life Insurance

By Matt Schmidt

Scouring the Internets for life insurance to cover your final life burial costs is the last thing someone wants to spend their free time doing. It’s a beautiful day out and you’re stuck inside on your computer looking at sites that tell you what’s “best” for you. It can be extremely frustrating and at times just downright confusing. One site says one thing, while another site almost says exactly the opposite. Where do you even begin?

That’s where we come in. Before you give up due to sheer frustration let us give it go… that’s what we are here for. We are here to help you get a better understanding on the best way to buy life insurance that will allow you to make an informed sound decision.

What is life insurance? Simply stated it is a type of insurance that pays your beneficiaries (who you would like to collect your benefit) a tax free cash benefit upon your passing. As long as you have a policy with any insurance company, that company will be obligated to pay cash directly to whomever you choose.

This cash will allow your family peace of mind knowing that your final life expenses will be covered and pay for. As long as you get enough coverage, your family will not be burdened with having to make up the difference.

Keep in mind the following two things when it comes to buying life insurance; there are no requirements that come along with the payout and any leftover money will stay with your family. What that means is that your family will be given cash, cash that they can spend on whatever they see fit for your final burial expenses. Whatever is leftover will not have to be given up; they can keep it and do with it what they will.

This is where things may get a little bit confusing but stick with us. There are many types of life insurance and each type of life insurance works a certain way. Selecting the type of life insurance that best fits your health and needs is critical.

There are so many types of life insurance because every person and their needs are different. Finding the right type of life insurance will ultimately help you and your family in the long run.

Primarily there are two types of insurance permanent cover and term coverage.  When you obtain permanent coverage there are 3 different types you can get whole life, universal life, and guaranteed universal life. The following sections will give you a breakdown of each type and how they work.

When you obtain permanent coverage there are 3 different types you can get whole life, universal life, and guaranteed universal life. The following sections will give you a breakdown of each type and how they work.

Term life insurance is a type of life insurance that you get temporarily. You can either have it until a certain age or for a certain amount of years and is single-handedly the least expensive type of life insurance on the market.

When your coverage reaches the predetermined age or acquired years your coverage is terminated. Everything you have invested in the term coverage will not be returned. The worst part of this type of insurance, depending on your age you may not be eligible for another term policy. You would have to take out a permanent coverage policy that will be extremely expensive.

A good rule of thumb when it comes to term life insurance is that they usually provide insurance until you are about 80 years old (if you’re lucky 85). Once you reach 85 years old you’re on your own looking for new coverage.

The reason that term life is so cheap is because the insurance company is banking on you outliving that 85-year-old cutoff. Since the risk is so high to them they try to manage that risk in the underwriting. Which is why it is extremely restrictive. They are trying to eliminate their risk of having to pay out any individuals who may pass during their period of coverage. Best case scenario for them is that you live to be past 85 years old, your term policy expires, and they don’t have to pay out any death claims.

The underwriting health questions are extreme in term coverage for that reason specifically. Insurance companies do not want to take the risk of someone passing before their policy is up.

In our opinion, the safest type of permanent life insurance is whole life insurance. You gain immediate coverage that will last for as long as you pay your monthly premiums. The downfall of whole life insurance is it is the most expensive type of life insurance. You are guaranteed coverage no matter what, which is why it costs more.

As you make payments over the years to a whole life policy it builds cash value. The more you put in, the more you get out at the end.

What is nice about whole life insurance policies is you can access it for emergencies or to pay your premiums. Although it is not a common practice if you get behind on your premiums or run into a situation where you need a significant amount of money you are able to take a loan from your policy. The insurance company expects you to pay back your loan in full with interest. If for some reason or another you are unable to pay said loan back, it will be deducted from your final benefit payout.

It is without a doubt tens times easier to get whole life insurance as compared to term life insurance. The risk isn’t there as it is with term life insurance. Which is why they are able to take clients whose health may be diminishing.

The reason behind this is because the individual is paying their higher premiums every month that is already equal to their death benefit. Even upon matching your policy payout, you continue to pay those premiums. Be aware that payments do not stop just because you have reached the amount of the policies pay out.

You are paying higher premiums for protection. From day one you are covered and the insurance company is on the line. This is how they make their profit and remove the risk. No matter what the insurance company pays, it is just a matter of when.

This type of insurance policy is a combination of term life and whole life. Be aware in your researching you may come across it being called “variable premium life” or “flexible premium life. This is the trickiest of all types of insurance policies to understand and follow. If you don’t have a clear understanding of the policy you may find yourself in trouble.

For the most part this type of policy does cost less than a whole life insurance policy. On one hand that’s great, however on the other hand that’s because there are fewer guarantees.

A universal life policy relies heavily on the cash value growth in order to keep the policy in force. The growth that you may see comes from the insurance company investing your payments.

We continue to tell our clients the best time to get life insurance is now. The reason behind this is because it is cheaper for a 55-year-old to get life insurance than it is a 60-year-old. While the cost of your insurance rises with time, your monthly payments remain the same.

As you age, less and less money is being contributed to your cash value because of the higher cost of insurance. One day your cost of insurance will be greater than your monthly payment. At this point, your policy will begin to draw from the cash value to make up the difference. This happens instead of you having to pay more money each month.

Being aware of this from the beginning will help you make sure your cash value never reaches zero. If this does happen you will find yourself paying 200-500% more. If your policy ends and you no longer have protection you will have to pay more to get new protection.

Although whole life underwriting is the most easy going universal life underwriting is still better than term coverage underwriting. If you have minor health issues you should still be able to qualify without a problem.

If you fall into the category of having some serious health issues you may just want to get a whole life policy. In all probability, you will not be able to qualify and even if you did your payments would be outrageous and not worth it in the long run.

Similar to universal life insurance guaranteed universal life insurance will build little to no cash value. Which simply means you will not be able to see any growth in the money you contribute. You’re putting in just enough to get you coverage. As long as you make your payments you will be covered.

Where you get into trouble is when you miss a payment. Missing a payment will cause you to have to pay a substantially higher amount than what your previous payments were. Although guaranteed universal life is the lowest cost of permanent coverage you are putting yourself in a potentially serious risk if you ever miss a monthly payment.

GUL underwriting is pretty lax when it is compared to the other types of permanent coverage. Individuals with minor health issues will be able to qualify easily. Since the insurance company is taking on the majority of the risk they will never receive premiums that are equal to or greater than the death benefit.

Once again you have an example of an insurance company hoping that you miss a payment, which causes you to drop the policy. That way they are off the hook.

What Type of Coverage is Best?

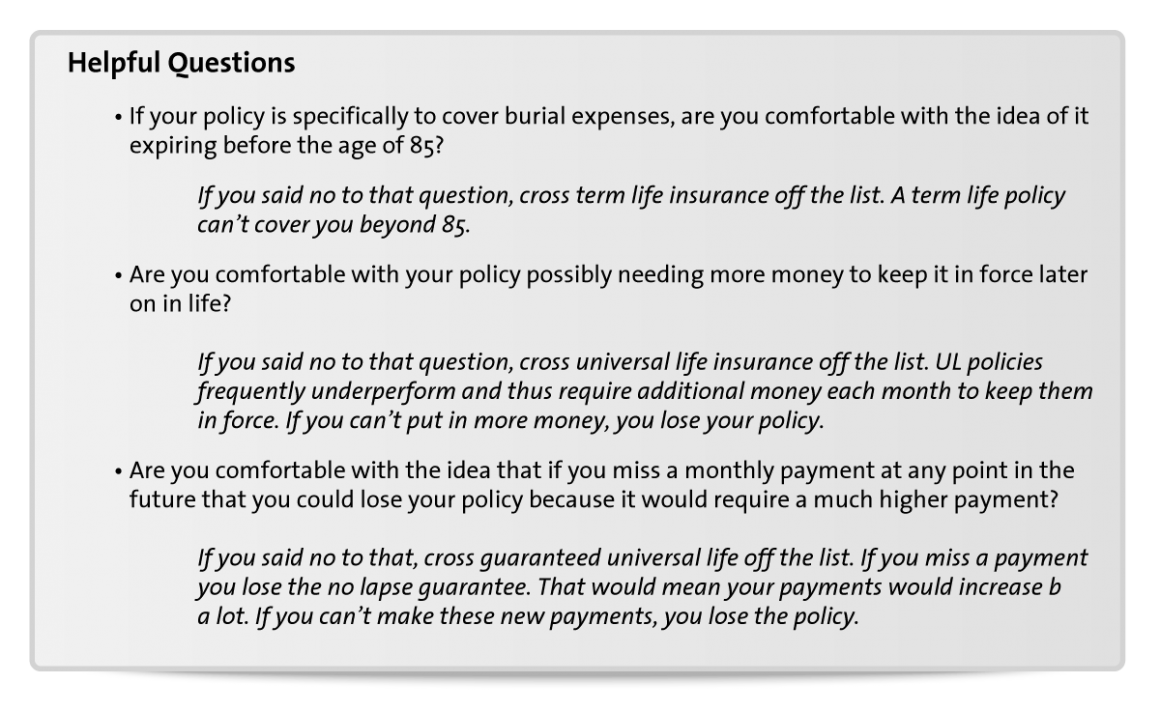

That is the question that most of our clients ask us. Honestly, it comes down to what suits your needs and your lifestyle best. The following questions will help you figure out what would be the best type of coverage for you.

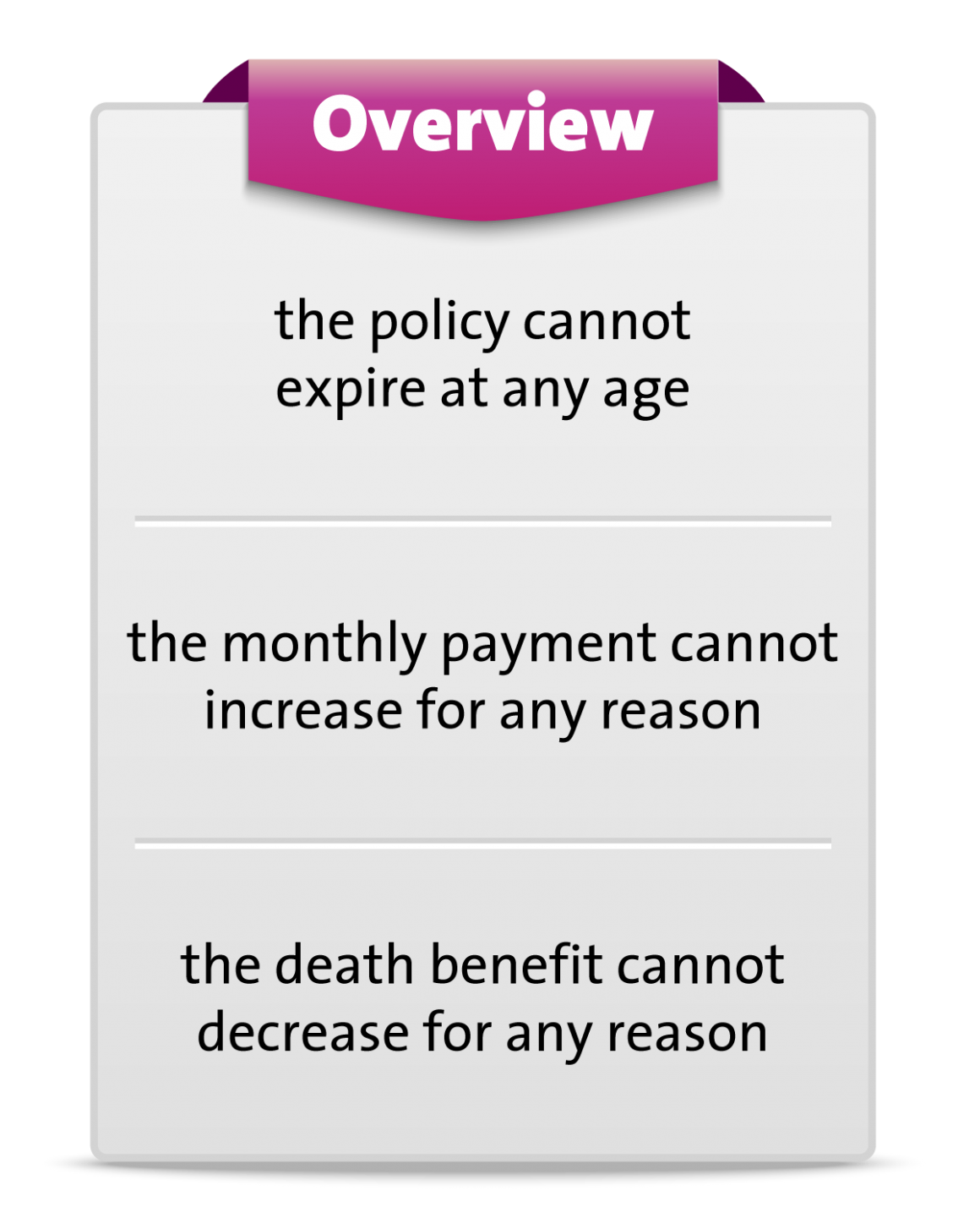

Usually, when our clients come to us they want the real deal guaranteed life  insurance policy. A policy that will be fully guaranteed no matter what. In our opinion the safest type of permanent life insurance is whole life insurance. You gain immediate coverage that will last for as long as you pay your monthly premiums. The downfall of whole life insurance is it is the most expensive type of life insurance. You are guaranteed coverage no matter what, which is why it costs more.

insurance policy. A policy that will be fully guaranteed no matter what. In our opinion the safest type of permanent life insurance is whole life insurance. You gain immediate coverage that will last for as long as you pay your monthly premiums. The downfall of whole life insurance is it is the most expensive type of life insurance. You are guaranteed coverage no matter what, which is why it costs more.

As you make payments over the years to a whole life policy it builds cash value. The more you put in, the more you get out at the end. There’s no such thing as a sure deal, but when it comes to permanent coverage whole life insurance is as close to it as you can get.

If you go with a policy other than whole life and you lose it for the stated reasons why it might go away, how then will you pay for your burial expenses? The other types of policies either expire, contain the capacity to expire, or have the potential to increase in cost where you can’t afford the payments. Sadly, these potential outcomes usually play out. Why risk it?

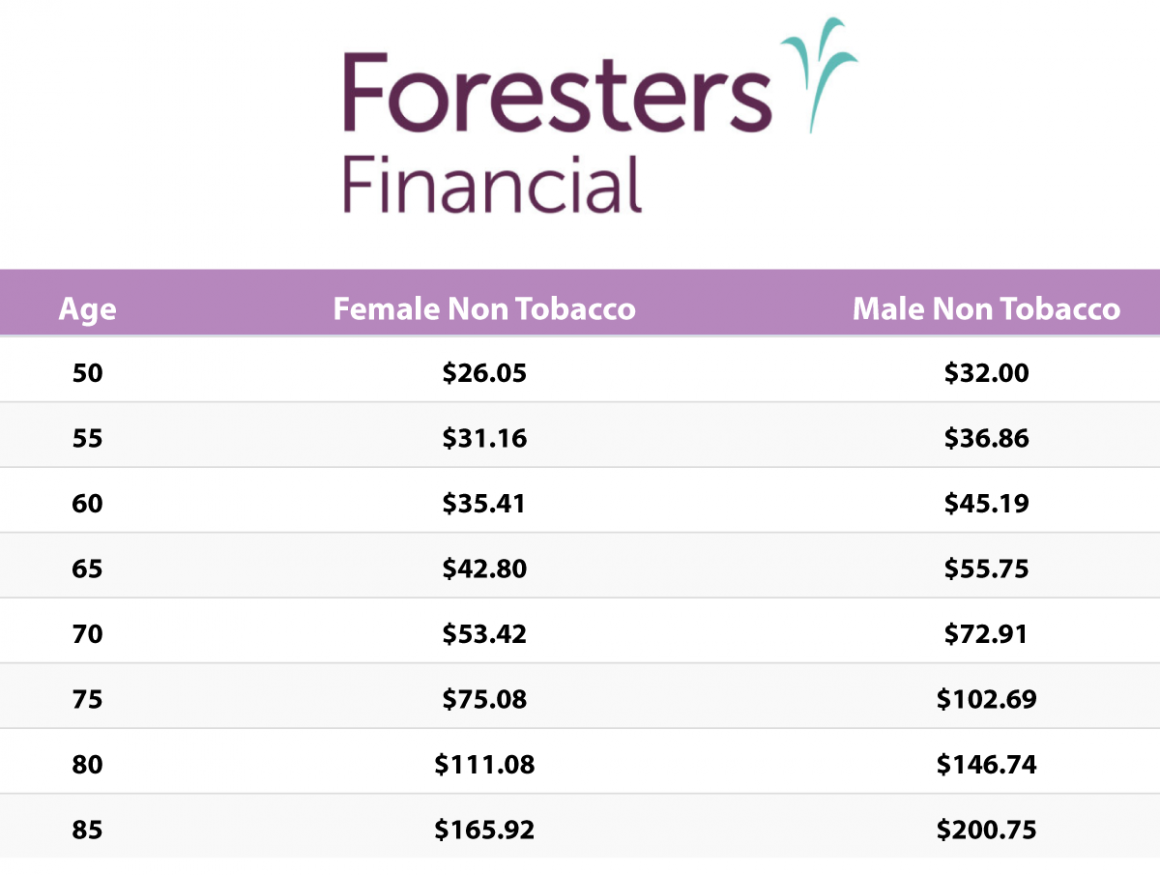

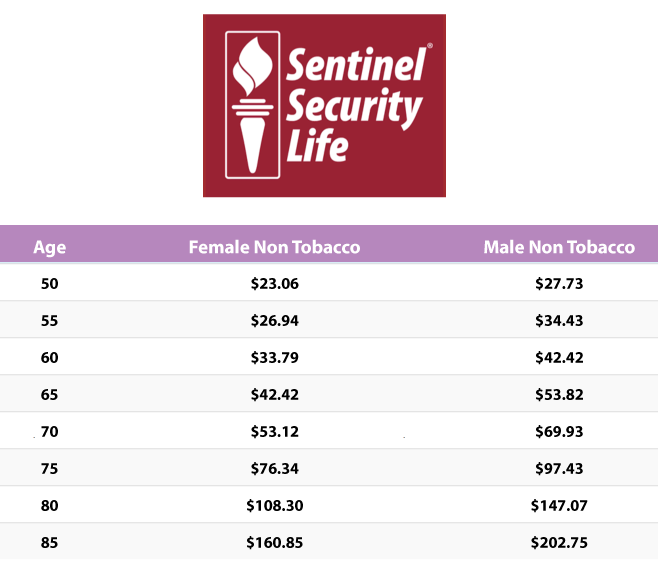

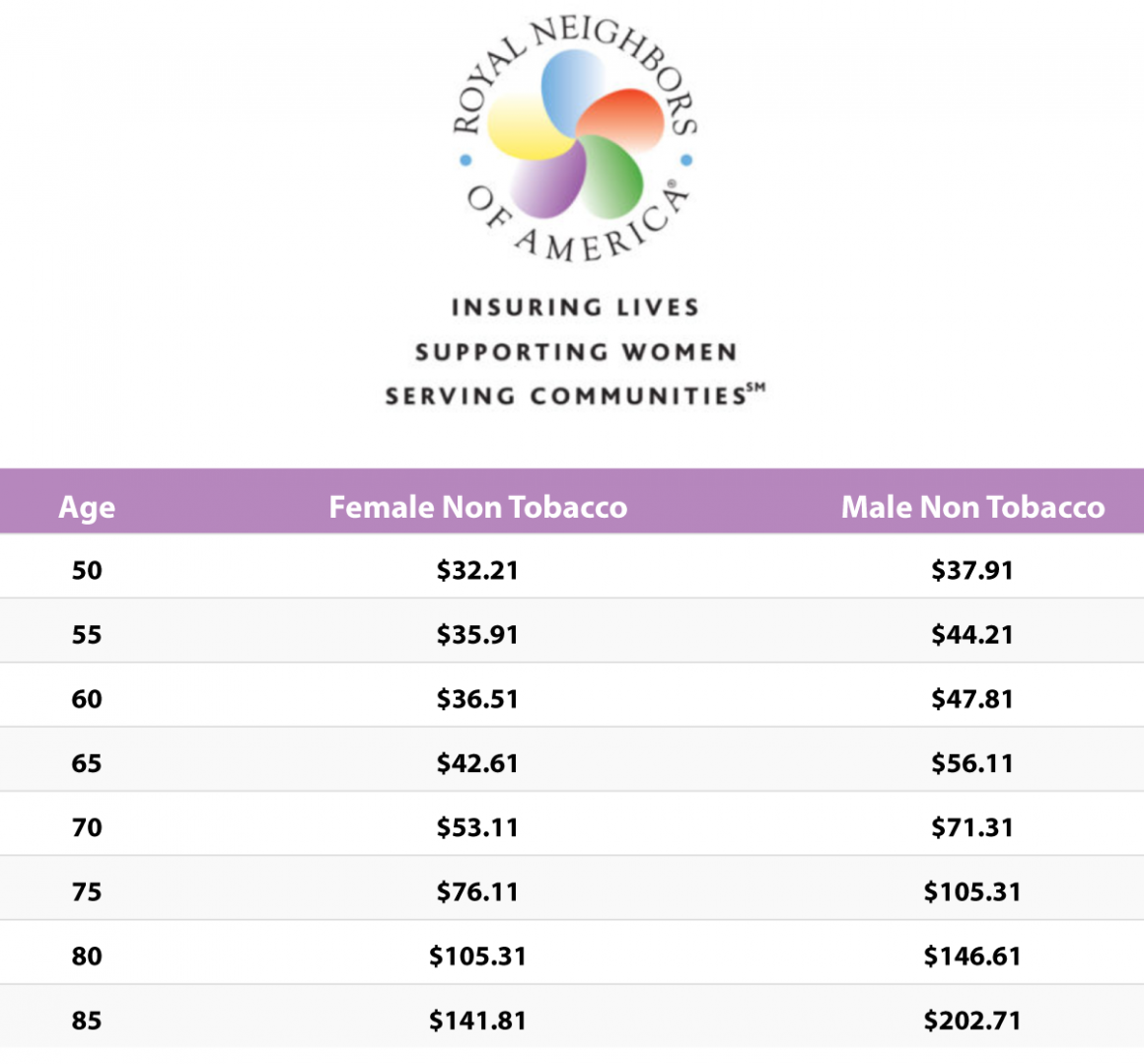

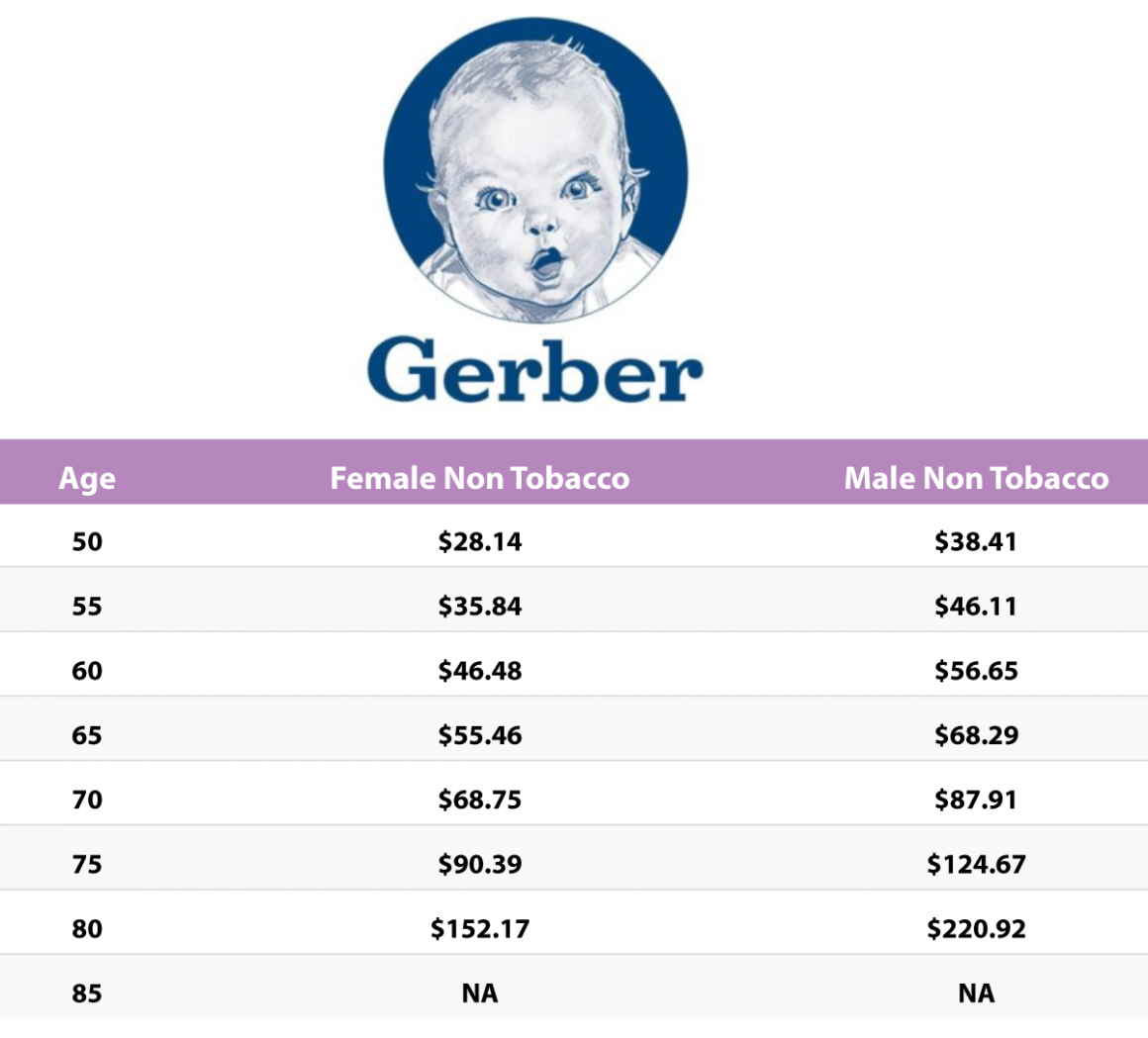

We have pulled together a few charts to give you a better idea of what $10,000 of whole life insurance protection would. Please keep in mind these are quotes for non-tobacco user rates.

How To Find The Best Policy

Leave the heavy lifting to us. That’s what we are here for! When it comes down to it, it doesn’t matter what type of health issues you have. Finding the best policy comes down to the following three simple rules.

1) Finding a burial insurance company that has a financial stable track record that is able to pay out any and all claims

2) Finding a policy that will protect you as soon as you sign up

3) Finding the lowest monthly premium that will all you to have the best burial insurance coverage possible

We will be able to find the best policy for you because we have the knowledge and understanding of what it takes to get the lowest cost final expense policies. These policies can only be sold through agents and agencies like us!

The time is now. Now is the best time to plan on obtaining burial insurance to ensure your final expenses are taken care of and your premiums stay low. Keep in mind that your burial insurance will never be cheaper than it is today. The sooner you have it the sooner you’ll appreciate it.

Enlisting the help of a qualified independent agency, that represents lots of different insurance companies will help you find the perfect fit to you and your health/medical needs. The best part about independent agencies is that they aren’t married to one insurance company, so they will be able to find you the best deal out there!

We have helped many people find the coverage they need at a price that is affordable. We know your options and we help you sort through them – answering any questions you may have along the way. You are not in this alone.

Contact us today to get started!