Colonial Penn Burial & Life Insurance Review for 2026

Last Updated on February 24, 2026 by Matt Schmidt

A Review of Colonial Penn Burial Insurance

A Review of Colonial Penn Burial Insurance

The following review is an analysis of one of the most recognized players in its industry. Started nearly fifty years ago by AARP co-founder, Leonard Davis, Colonial Penn is a subsidiary of CNO Financial Group Inc. They a licensed in 49 states and currently rated as B++ by A.M. Best. When looking for an insurance policy, it is often recommended to select a company with a rating no less than A-.

Despite being the first insurance company to develop a no health question life insurance policy, Colonial Penn has struggled to deliver a quality burial insurance product to the marketplace. They command a strong advertising presence with prolific figures such as Alex Trebek, Ed McMahon, and Joe Theismann endorsing the business. Colonial Penn also has strong web and direct mail advertisements targeted at individuals over the age of 50. However, while their policies are described in a manner which makes them appear to be an economical bargain, pricing is obscured in such a way that can be confusing to its customers. For example, the practice of selling their policies on a “per unit” basis, Colonial Penn intentionally obfuscates its pricing models to subtly mislead the audience. For example, 1 unit can represent $500 in burial insurance or it can represent $1,000 in coverage. Factors such as age and sex of an individual determine the amount of coverage provided in the policy. The use of this “unit” system tends to be subversive and misleading.

Despite being the first insurance company to develop a no health question life insurance policy, Colonial Penn has struggled to deliver a quality burial insurance product to the marketplace. They command a strong advertising presence with prolific figures such as Alex Trebek, Ed McMahon, and Joe Theismann endorsing the business. Colonial Penn also has strong web and direct mail advertisements targeted at individuals over the age of 50. However, while their policies are described in a manner which makes them appear to be an economical bargain, pricing is obscured in such a way that can be confusing to its customers. For example, the practice of selling their policies on a “per unit” basis, Colonial Penn intentionally obfuscates its pricing models to subtly mislead the audience. For example, 1 unit can represent $500 in burial insurance or it can represent $1,000 in coverage. Factors such as age and sex of an individual determine the amount of coverage provided in the policy. The use of this “unit” system tends to be subversive and misleading.

Colonial Penn Burial Insurance Plans

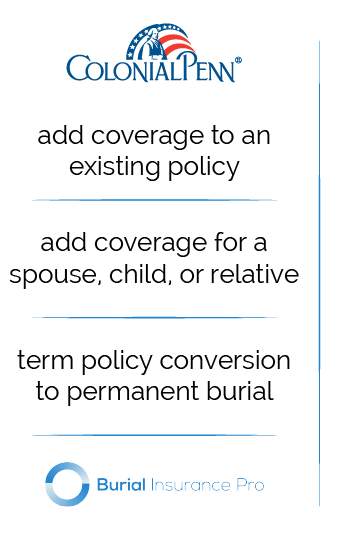

Colonial Penn currently has two main burial insurance plans. The most popular offering is their guaranteed acceptance whole life burial insurance. The second is an easy issue whole life burial insurance plan which requires applicants to provide answers to some health related questions. Of the two, the former is the most widely marketed to the public.

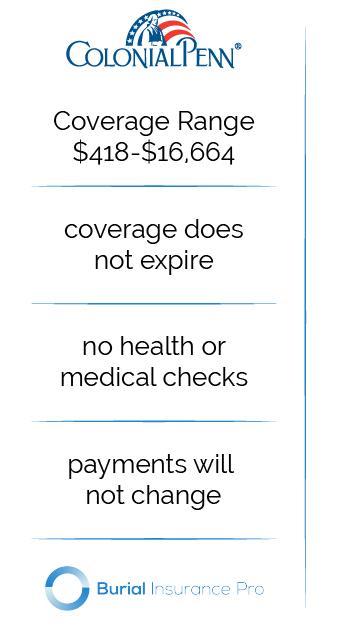

Guaranteed Acceptance Burial Insurance

Guaranteed Acceptance Burial Insurance

This is a true permanent burial insurance plan. Its terms are simple, monthly price will remain constant, and benefits will never decrease. However, drawbacks include a waiting period and high price point which is largely more expensive than many competitors (specifically, Gerber Life and Mutual of Omaha offer a comparable product at a considerably lower price). The waiting period for this plan is a result of the policy’s guaranteed acceptance without a required health screening or medical check. The waiting period is designated as two years. Enrollees who pass away during this waiting period are not paid out the benefit amount. Rather, paid premiums are refunded plus 7% interest compounded annually. After the two year waiting period,

After the two year waiting period has elapsed, the full policy value becomes effective and will remain so for one’s remaining life. The policy will also pay out if death is the result of an accident. For example, policy-holders would be covered in the event of automotive or plane crash. This policy is offered to customers between the ages of 50-85. Online payments can be made using one’s banking information or credit card and there are additionally three manual pay options. Bills can be scheduled to be recurring quarterly (every 3 months), semi-annually (every 6 months), or annually (once a year). Payments cannot be made via direct bill. Monthly billing must be done either by bank draft or credit card.

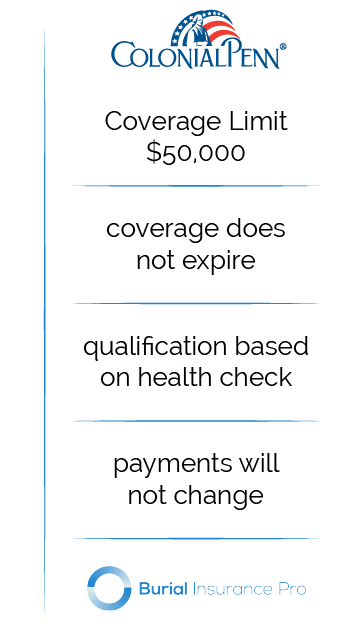

Immediate Benefit Whole Life Plan

Immediate Benefit Whole Life Plan

Similarly, this plan is true burial insurance. There is no expiration for the coverage and monthly payments cannot change. The benefits will not decrease over time and coverage is effective from day one. Smokers, tobacco and e-cigarette users do not have to pay an increased premium. Pricing is high for the guaranteed issue product.

Health Qualification Questions

To be eligible for Colonial insurance you will need to be able to answer the following health questions:

- Are you using a wheelchair, oxygen to assist with breathing, confined to a hospital or nursing facility, receiving home health or hospice care, or are you currently disabled due to illness?

- Have you had or been treated for Acquired Immune Deficiency Syndrome (AIDS), AIDS Related Complex (ARC), or tested positive for antibodies to the Human Immunodeficiency Virus (HIV)?

- In the past 3 years, have you had or been treated for:

– Chronic Obstructive lung disease, coronary artery disease, or any disease or disorder of the heart brain or liver?

– Cancer, chronic kidney disease or kidney failure, muscular disease, mental or nervous disorder, drug or alcohol abuse, or have you been hospitalized for diabetes

– Any chronic illness or condition which requires medication or periodic medical care, or have you been advised to have surgery which has not been performed?

- Are you currently undergoing evaluation, diagnostic testing or treatment, or been advised to have testing not yet completed?

Answering “Yes” to any of these questions will result in being declined a policy from Colonial Penn.

Answering “Yes” to any of these questions will result in being declined a policy from Colonial Penn.

Guaranteed issue policies attract customers with very serious health issues. For that reason, the insurance companies, in turn, charge a higher rate for the insurance to offset the cost of death claims. The insurance market offers various policy solutions. Many accept clients with different health conditions such as diabetes. Some organizations will charge an increased fee to insure such individuals which is why it is highly important that you work with an agency that is independent. Customers should be weary to avoid companies which offer burial insurance plans which expire for a client once he reaches a certain age, deeming the policy invalid.

Summary

Colonial Life is a well-known company with popular marketing campaigns and celebrity endorsement. Their two policies are mostly straightforward to the customer. Neither of the products will expire, both have fixed monthly prices, and the benefits will never decrease. There are, however, two major downfalls to their policies. Price is expensive when compared against similar products. There are various competitor products which are offered at a lower price. The second drawback is the absence of an independent agent. Colonial Life does not offer a dedicated agent to service you. Instead, a customer service system is used with representatives licensed to sell insurance

Consumer Overall Goals

Consumer Overall Goals

If you’re looking for burial insurance that is the best for you and most cost effective, look no further. Our focus here at Burial Insurance Pro’s is burial insurance. That’s what we do and what we excel in. The years of experience we have with our clients allows us the knowledge to know which insurer would suit your needs the best.

If you want an experts opinion, fill out the quote form or give us a call to help you out in all of your burial needs!