Americo Financial Life Insurance Review for 2026

Last Updated on February 24, 2026 by Matt Schmidt

Americo Financial Life Review

Life insurance is one of the ways you can help make sure that your loved ones will not be responsible for any type of debts upon your passing. While most people plan for their financial future by saving, it is also important to plan for your financial future upon your passing.

Burial life insurance is usually the go when planning for the future. When it comes to preparing for a funeral many people are oblivious to the fact that funeral arrangements can add up pretty quickly. Being aware of these potential expenses will put you ahead of the game and will help your family out in the long run.

How Much Does a Funeral Cost

In 2014, according to the National Funeral Directors Association, the average cost of a funeral was roughly $8,508. A noticeable increase in price from 2004, which was about $6,580. Below will give you a better estimate of some of the costs of a funeral courtesy of the NFDA. Please keep in mind these figures are just estimates of the bare minimum and do not include the cost of cemetery, flowers, obituaries or crematory fees. On average in the last 10 years the cost of a funeral increase roughly 30%.

Realistically when you are in your final days you tend to have higher medical bills compared to when you are in your prime. Instead of leaving all of those costs to your children, making the situation even more difficult, burial insurance coverage is specifically designed into paying off those extra costs.

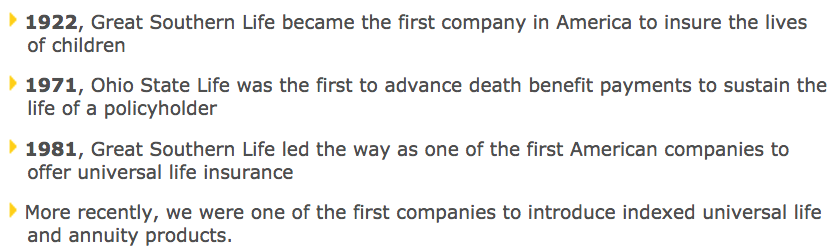

Americo’s History

Primarily located out of Kansas City Missouri, Americo has been around for more than 100 years and has hit some pretty impressive milestones.

Their growth has been built on the successful acquisition of several insurance entities that allow them to stand out in the insurance industry. Today Americo Financial Life has one of the largest independent, privately held insurance groups in the United States. Proving their three generations of success stories. Americo is one of the most respectable and reliable final expense insurances in the industry. If you already have Americo, rest assured, you are in a great position to be in.

Americo Financial Life Overview

Americo has four different types of plans you are able to qualify for. Their primary plans includes the Ultra Proector I Plan, Ultra Proector II Plan, Ultra Proector III Plan, and the Eagle Series Plan.

Since we are here to assess their plans, let us tell you now, some are significantly better than others. Their Ultra Protector III plan is one of those plans to avoid at all costs. We can easily find you a much cheaper guaranteed issue plane with one of our other companies.

On the other side of things, Americo’s Ultra Protector II Plan offers you the ability to get full coverage for burial insurance on the first day that you apply. Their UP2 Plan is extremely beneficial to individuals with COPD, liver or kidney diseases, or any diabetic complications since the plan accepts all previous health conditions.

Americo’s UPI Plan isn’t worth it. If you qualify for this plan we can find you significantly cheaper coverage elsewhere.

Finally their Eagle Series Plan is completely different their the previously mentioned plans. This plan is a type of plan made specifically with individuals who have tumors, recently suffered a heart attack, Parkinson’s Disease, or Lupus. This is where Americo really excels in when it comes to their plans, they are able to help individuals with specific health conditions notably more than other companies.

Americo Financial Life Full Review

Ultra Protector Plan I – this plan availability starts at a minimum of $2,000 and goes up to $30,000 as long as you are between the ages of 50-85 and can answer no to all of the health questions.

Ultra Protector Plan I – this plan availability starts at a minimum of $2,000 and goes up to $30,000 as long as you are between the ages of 50-85 and can answer no to all of the health questions.

This plan also comes with a few different types of riders.

Accelerated Benefit Payment: if you are ever diagnosed with a terminal illness and expected to pass within 12 months (24 months in IL, MA or TX). Americo will allow you to use 50% of your death benefit to go towards any surprises expenses. Maxing out at $15,000 with a minimum of $1,000. This rider kicks in automatically and is free.

Accidental Death Benefit: although you have to pay additional money for this rider it provides additional payment if you pass away due to an accident

Children’s Term Benefit: you must be at least 60 years or younger to apply this policy and is able to be converted into a new policy available on the child’s 23rd birthday.

This plan is overall a mediocre plan. If you qualify for this plan there are definitely other types of plans with different companies that we can help you qualify for and with better rates. Why pay more if you don’t have to? Let us find you a cheaper option!

Ultra Protector Plan II – to be eligible of this plan you need to be able to answer ‘no’ to all of the health and medical questions. That’s where we come in, let us go through all of the Ultra Protector II health questions with you to see what plan would best fit your lifestyle.

Ultra Protector Plan II – to be eligible of this plan you need to be able to answer ‘no’ to all of the health and medical questions. That’s where we come in, let us go through all of the Ultra Protector II health questions with you to see what plan would best fit your lifestyle.

What’s nice about this plan is you can buy as little as $2,000 or as much as $30,000 and is available in all states except MS, NY, and VT. Not to mention if you are between 50-80 years old you can apply for this final expense coverage.

Similarly this plan comes with the same types of riders as the UPI plan.

Some of the perks of this policy is the fact that you get instant protection in spite of serious health problems as well as fantastic prices for tobacco use combined with certain health conditions. Americo’s Ultra Protector II plan is one of the only companies that will issues you first day coverage if use insulin, been in a diabetic coma, have had suffered from a diabetic amputation or have eye and kidney problems due to diabetes. This type of insurance is extremely rare to find if you suffer from any of the previously stated health conditions which is why Americo is the leading company when it comes to helping diabetics find insurance.

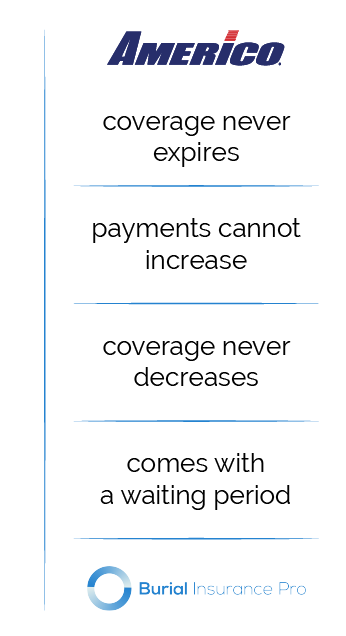

Ultra Protector Plan III – steer clear from this plan! This plan is basically a guaranteed issue plan that asks no health questions or care about your medical history. This plan offers no underwriting which is why there is a waiting period.

Ultra Protector Plan III – steer clear from this plan! This plan is basically a guaranteed issue plan that asks no health questions or care about your medical history. This plan offers no underwriting which is why there is a waiting period.

Oh a waiting period no big deal? It takes a full 3 years before you get 100% of your payout. This is one of the longest waiting periods on the market and is absolutely absurd. Most other burial insurance companies that require a waiting period only take two years.

If you don’t want to answer health questions you will automatically be put into this plan. Obviously answering a few health questions would be more beneficial and put you in a better priced plan. If you’re concerned with what the health questions may be, we can go over them with you in detail. Even if you do have some preexisting health conditions we can find a company that freely accepts these conditions for much less. Not only that but if you have to have a guaranteed issue policy we can hook you up with Gerber Life who charges less than half the price for the same thing with only a two year waiting period.

Why pay for something where you can be insured much quicker somewhere else? This is one of the biggest reasons we tell our clients not to even touch this plan.

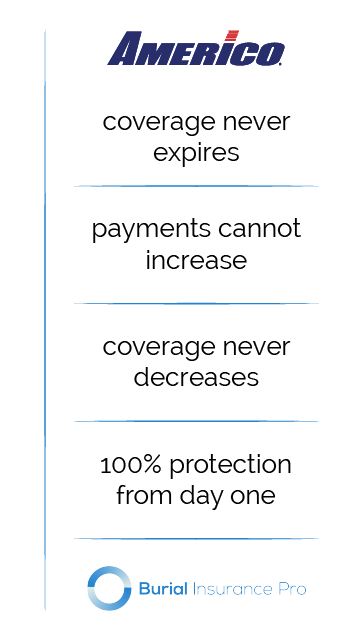

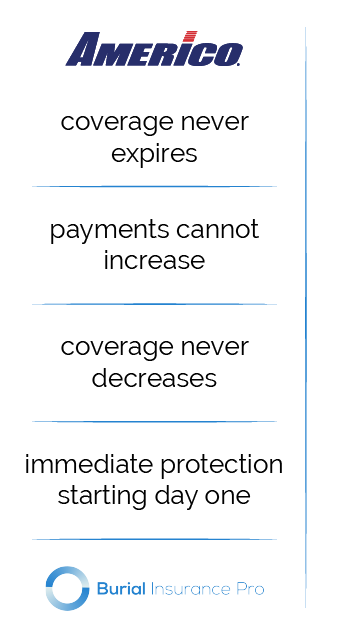

Eagle Series Plan – another mediocre plan that lacks the common plan practices that their 3 previously stated plans have. However, since the application and underwriting process is completely different it does offer a benefit to individuals who have certain health conditions. What’s nice about the Eagle Series Plan is the coverage never expires, payments cannot increase, coverage never decreases and you are able to receive first day coverage with no waiting period!

There are four ways to determine if you qualify:

– Health questions

– Prescription history

– MIB information

– Compare your height and weight to their build chart

As long as you say no to all of the health questions you will be eligible. Feel free to reach out to us and we can go over all of their qualifying health questions!

Americo’s Eagle Plan really excels when it comes to very specific health histories.

– Heart attack at least 1 year ago, but less than 2

– Full blown stroke at least 1 year ago, but less than 2

– Cancerous tumors

– Early age diabetes

– Parkinson’s disease

– Systematic Lupus

If you find yourself realizing you have any of those previously mentioned health conditions Americo’s Eagle Plan may be the best fit for you! Intrigued by what they could possibly offer you? We can definitely can go over all of your options in more detail if you give us call.

Finding The Best Burial

Finding the best policy comes down to the following three simple rules.

- Finding a burial insurance company that has a financial stable track record that is able to pay out any and all claims

- Finding a policy that will protect you as soon as you sign up

- Finding the lowest monthly premium that will all you to have the best burial insurance coverage possible

What’s nice about us, is we are able to find the best policy for you because we have the knowledge and understanding of what it takes to get the lowest cost on final expense policies. These policies can only be sold through agents and agencies like us!

At Burial Insurance Pro’s, we have the knowledge. We know the ins and outs of finding best policies out there. Don’t waste your time, let us take care of your questions, thoughts and concerns when it comes to any company you may be looking into for your insurance needs.

Let us help you make solid recommendations that are tailored to you and your lifestyle. We know your options and we help you sort through them – answering any questions you may have along the way. Contact us today to get started! We’d love to earn your business.